The Reserve Bank of Australia (RBA) has increased the nation's official cash rate for the first time in more than 11 years, and two of the nation's big four banks have already passed the rate rise onto customers.

Today the RBA increased the cash rate by 25 basis points from 0.10 per cent to 0.35 per cent, marking the first rate rise since November 2010.

The average owner-occupier with a $500,000 debt and 25 years remaining on their mortgage will see repayments rise by around $65 a month.

In making his historic decision, RBA Governor Dr Philip Lowe said he was aware of the central bank's role to play in controlling inflation.

EXPLAINED: Exactly how much today's RBA rate rise will cost you

"The Board judged that now was the right time to begin withdrawing some of the extraordinary monetary support that was put in place to help the Australian economy during the pandemic," Mr Lowe said.

"The economy has proven to be resilient and inflation has picked up more quickly, and to a higher level, than was expected. There is also evidence that wages growth is picking up.

"Given this, and the very low level of interest rates, it is appropriate to start the process of normalising monetary conditions."

First banks pass down rate

Commonwealth Bank Australia announced on Tuesday night it would be passing the rate rise onto its customers, increasing its home loan variable interest rates by 0.25 per cent per annum.

That change will come into effect on May 20.

"This is an important time to support customers as some may not have experienced an interest rate increase since they took out their loans," CBA group executive, retail banking Angus Sullivan said.

"We are here to help customers who have loans and are considering how repayments might change. Some options available to help our customers manage repayments include fixing or splitting loans or setting up an offset account."

The ANZ said it will also increase variable interest home loan rates 0.25 per cent from May 13.

ANZ Group Executive Australia Retail Maile Carnegie said some people "are doign it tough" and they should contact the bank if they need support.

"In making this decision we considered various factors including the change in the official cash rate, along with the impact on our customers and our business performance.

"While this change will impact customers in different ways, home loan customers are generally well placed to manage rising rates with around 70 per cent of accounts ahead on repayments – many of them by two years or more. Household and business deposits are also at record highs."

Other major banks are yet to comment.

Experts explain decision

Economist Paul Ryan from PropTrack said that today's rise was a strong statement by the RBA that it is not influenced by politics.

"By moving today, rather than waiting for further data in June, the RBA is signalling that it will intervene to curb stronger than expected inflationary pressures, despite the ongoing federal election campaign," Mr Ryan said.

"While the RBA seeks to remain independent from politics, failing to adjust policy may have been viewed as a greater political intervention."

The last time the RBA increased interest rates during a federal election campaign was in 2007, when Opposition leader Kevin Rudd was contesting incumbent Prime Minister John Howard.

Mr Howard's Coalition government lost the election by a landslide just over two weeks later.

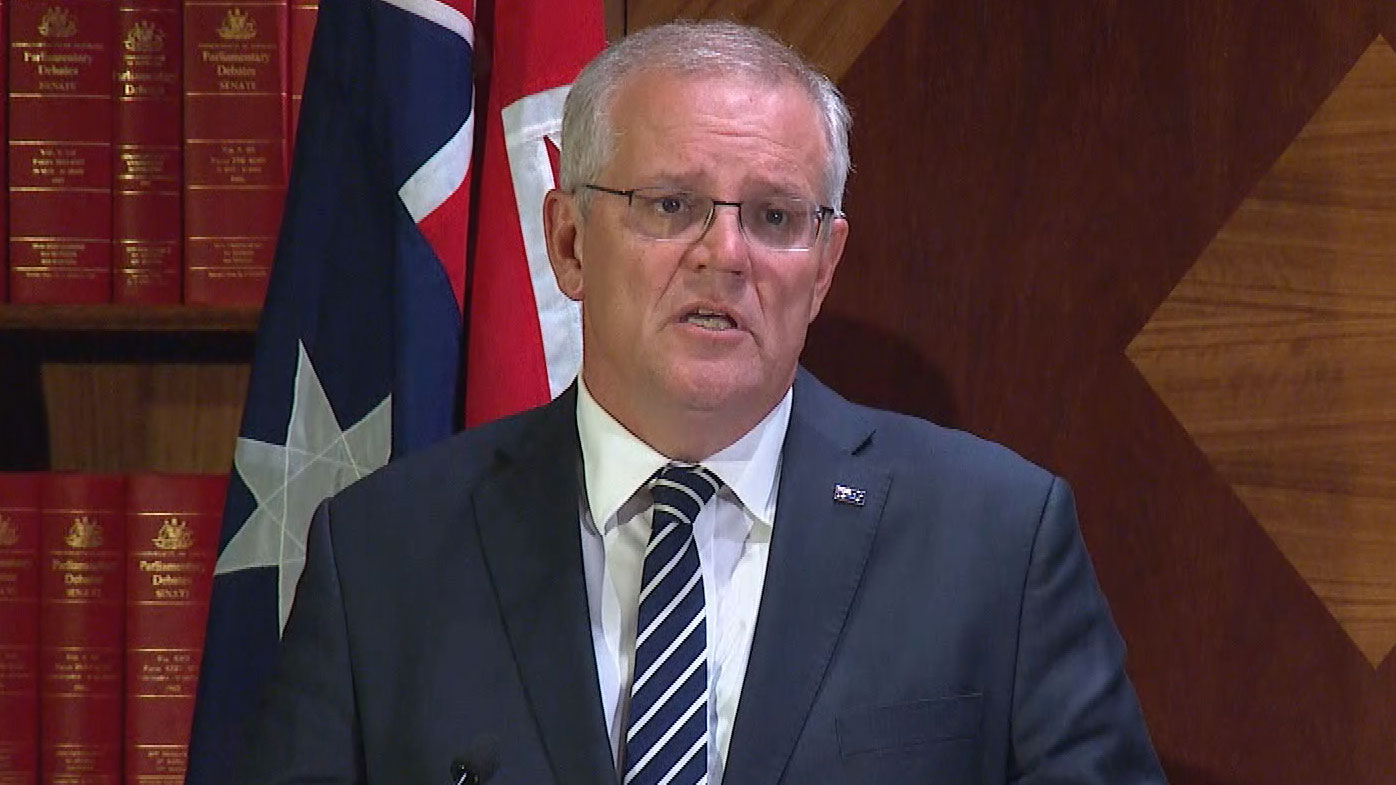

In a press conference Prime Minister Scott Morrison said Australians had been "preparing" for eventual rate rises.

"Throughout the course of the pandemic, we have seen them double their buffers on their mortgages," Mr Morrison said.

"We have seen them strengthen their own balance sheets in preparation for what they always knew would not be the continuation of extraordinarily low rates from the RBA.

"That's not something that Australians reasonably thought would go on forever."

Mr Ryan said today's hike was the tip of the iceberg for borrowers, who are being warned to factor in a number of rate rises this year.

"While this increase in rates was small, it signals the start of a series of interest rate rises before the end of 2022. This will weigh on housing price growth, which has clearly slowed in anticipation of these higher borrowing costs," he said.

"The outlook for housing prices later in the year is one of a balance between higher mortgage rates and the higher income growth the RBA is looking to see before raising rates."

READ MORE: Millions braced for mortgage pain, first rates rise in a decade

Sarah Megginson, senior editor of money at Finder, said some borrowers may find themselves caught short when having to deal with increases on their repayments.

"This rate rise, along with a property market that is beginning to cool, means some recent buyers may be caught out now – or when their fixed rate ends," Ms Megginson said.

"If your rate has jumped or looks like it is going to, it might be time to go home loan shopping and find a better interest rate."

Does the hike in interest rates now force you to cut back on other household expenses? We want to hear from you. Get in touch with reporter Stuart Marsh at [email protected]

The information provided on this website is general in nature only and does not constitute personal financial advice. The information has been prepared without taking into account your personal objectives, financial situation or needs. Before acting on any information on this website you should consider the appropriateness of the information having regard to your objectives, financial situation and needs.

Source: 9News