Home ownership will soon be in closer reach for millions more Australians as the federal government expands eligibility for its Home Guarantee Scheme (HGS), in a bid to tackle the housing crisis.

Under one of the changes friends and family will be allowed to team up to buy a first home as the definition of the word "couple" will be changed from those who are married, or in de-facto relationship, to "any two eligible individuals" from July 1.

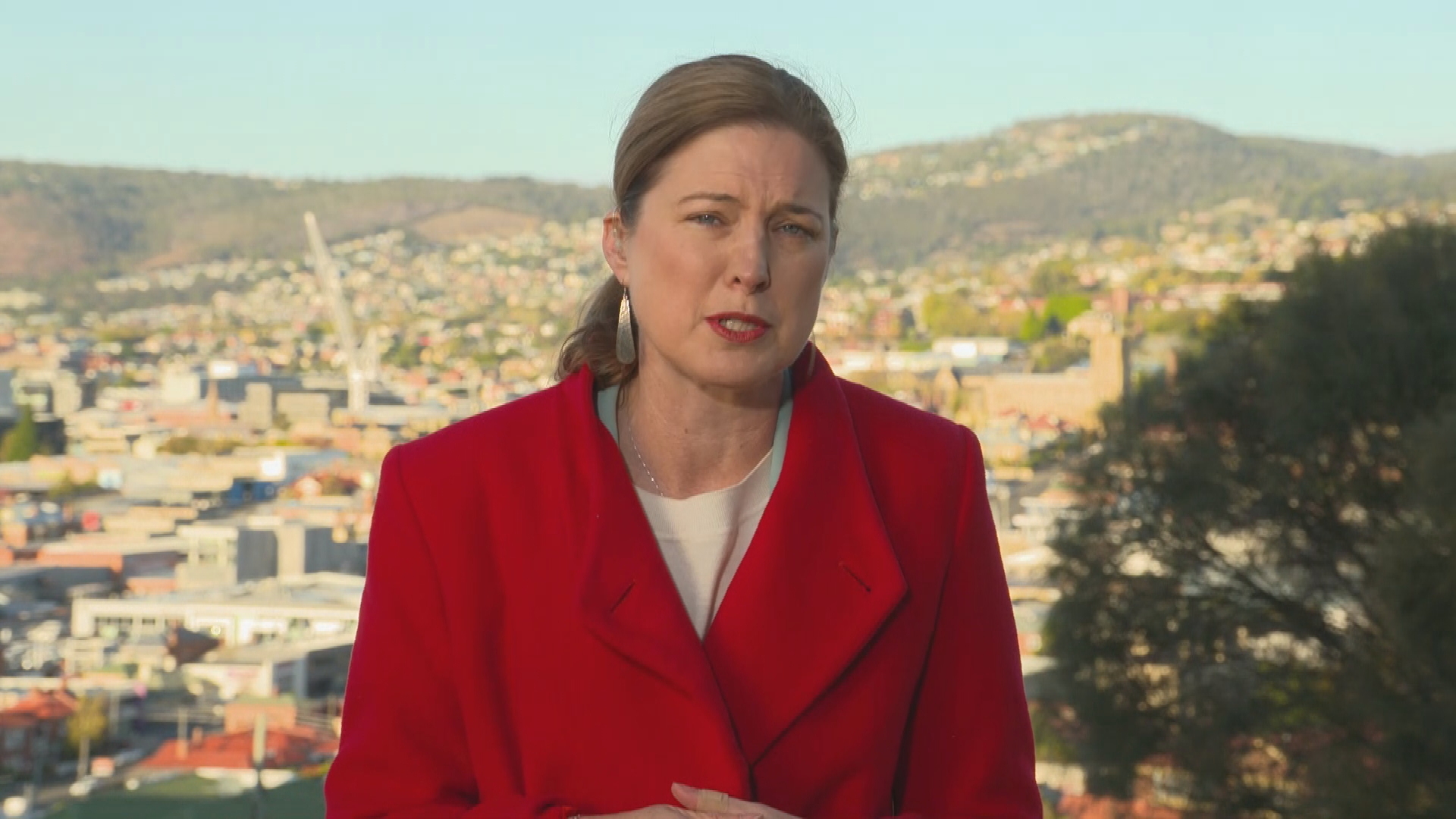

Federal Housing Minister Julie Collins has told Weekend Today the eligibility expansion is about "moving with the times".

READ MORE: How other nations have moved to tackle housing affordability

"What we are doing here, is widening the eligibility criteria. What we want to do is support more Australians to get into a home," Collins said.

"(It's) particularly (for) those who have been long-term renting (or) those who are having difficulty over coming the 20 per cent mortgage deposit threshold.

"We need to accept that different people, are doing different things to get into home ownership and that is what today's changes are about."

Under the scheme the federal government acts as a guarantor making up the majority of a loan for prospective buyers,

Lenders Mortgage Insurance (LMI) is also waived.

READ MORE: Your landlord slugs you with a huge rent increase. What can you do?

What are the changes and how will they work?

The HGS includes three different Guarantees:

- First Home Guarantee, which supports eligible first home buyers with a deposit as little as five per cent.

- Family Home Guarantee, which supports eligible single parents with a deposit as low as two per cent.

- Regional Home Buyer Guarantee which helps regional buyers crack into the housing market.

The Family Home Guarantee is currently only open to single parents with at least one dependent child.

Under the new changes this will be extended to single legal guardians of children from July 1.

It means guardians of children such as grandparents, aunts, uncles or foster carers will become eligible.

Australian permanent residents will also be included in the expansion, instead of just citizens.

The scheme will also widen to people who haven't owned a property in 10 years, helping those who have lost their home in financial crisis or a relationship breakdown.

READ MORE: Man allegedly stabbed multiple times outside venue in Sydney's south

Collins said the scheme would be capped at 50,000 places to ensure it would not impact the housing market.

"We have price caps on it, and what we don't want to do, is impact prices but obviously we do want to get and support Australians into home ownership sooner," she said.

"This is just a part of the suite of reforms we are doing as a government."

The changes come weeks after new research by YouGov showed nine in 10 people believe young Australians will never own their own homes due to the cost of living crisis and interest rate hikes.

Nationals Leader David Littleproud said the changes would help the housing crisis in a "small way".

"It's part of the total package of solutions that are required but the biggest challenge we have got, is supply," he told Weekend Today.

"We need to increase supply and there is going to be more pressure now that the government wants to bring in 650,000 new migrants over the next two years."

Sign up here to receive our daily newsletters and breaking news alerts, sent straight to your inbox.