The royal commission's report into the robodebt scandal has lashed the scheme as a "crude and cruel mechanism, neither fair nor legal" perpetuated through "venality, incompetence and cowardice".

The report referred individuals for civil and criminal prosecution and included 57 recommendations.

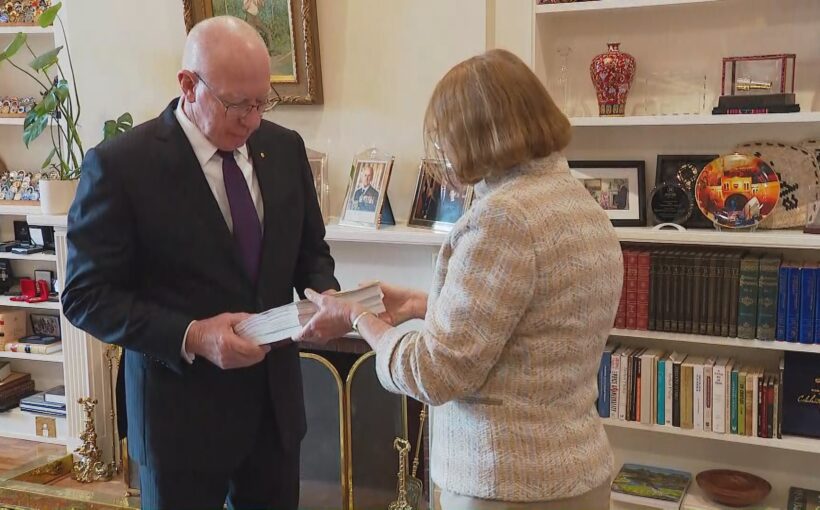

Royal commissioner Catherine Holmes confirmed earlier that a confidential, sealed chapter of the report would recommend the prosecution of some individuals. It is sealed "so as not to prejudice the conduct of any future civil action or criminal prosecution".

READ THE FULL REPORT: Royal Commission into robodebt

In her preface to the report, Holmes said she expected to uncover how the "patently unreliable methodology" of income averaging could have become part of a government debt raising and recovery scheme."

"What has been startling in the Commission's investigation of the Robodebt scheme has been the myriad of other ways in which it failed the public interest," she wrote.

"It is remarkable how little interest there seems to have been in ensuring the Scheme's legality, how rushed its implementation was, how little thought was given to how it would affect welfare recipients and the lengths to which public servants were prepared to go to oblige ministers on a quest for savings."

The report made a total of 57 recommendations to strengthen the public service, improve the Department of Social Services and Services Australia, and reinforce oversight agencies.

The commission was blunt in stating that the circumstances faced by welfare recipients under robodebt were "not normal".

"These were demands for often inexplicable debts, made of bewildered people who had no warning that DHS was suddenly going to raise a debt against them and, in some instances, had no warning that DHS had, in fact, raised a debt against them," the report read.

Among the commission's findings was a scathing indictment of the evidence provided by former prime minister Scott Morrison.

"The commission rejects as untrue Mr Morrison's evidence that he was told that income averaging as contemplated in the Executive Minute was an established practice and a 'foundational way' in which DHS worked," the report read.

The commission said the DHS officers who developed the proposal, were unlikely to have described income averaging to Morrison as "foundational".

The report found Morrison "failed to meet his ministerial responsibility to ensure that Cabinet was properly informed about what the proposal actually entailed and to ensure that it was lawful".

The 57 recommendations fall into the below categories

- Effects of Robodebt on individuals

- The concept of vulnerability

- The roles of advocacy groups and legal services

- Experiences of Human Services employees

- Failures in the Budget process

- Data-matching and exchanges

- Automated decision making

- Debt recovery and debt collectors

- Lawyers and legal services

- Administrative Appeals Tribunal

- The Commonwealth Ombudsman

- Improving the Australian Public Service

No compensation for victims

The commission has "reluctantly" concluded there is no practical way of establishing a compensation scheme for those affected by Robodebt.

"The impacts of (Robodebt) on the people embroiled in it were vividly illustrated in the evidence before the Commission from the witnesses who spoke of the distress and damage they had suffered and, of course, the evidence of the mothers of the two young men who took their own lives, at least in part because of it," the report found.

"It is impossible to devise any set of criteria that will apply across the board, because people were affected in such varying ways."

The commission also did not find in favour of a government apology to Human Services staff affected by the saga, concluding that an apology issued by fiat would be "not worth very much".

Morrison did apologise for the robodebt scheme to people affected by it while in office.

The commission suggested that in lieu of a compensation scheme, more money be directed towards raising social security payments.

'Deliberately misled'

The government engaged in "constant misrepresentation" that Robodebt involved no change in income or debt assessment, the report found.

The commission found the Ombudsman had been "deliberately misled".

It noted there was evidence government officials had lost their positions or been transferred after questioning or pushing back againstrobodebt – but that there was not enough evidence to conclude that such changes were part of an attempt to prevent scrutiny on the debt collection scheme.

'Staff were not listened to'

One of the "worst aspects" of the government's response to concerns about robodebt was its resistance to warnings from its own staff, the report said.

"Some of the witnesses who gave evidence before the Commission would make one despair of the Australian Public Service; but there were others, like Colleen Taylor, who restored faith," the report said.

"The shame is that people of her calibre were not listened to."

Taylor, a Centrelink employee, raised concerns about robodebt within the Department of Human Services in 2017.

"She saw clearly that the emperor had no clothes and did her best in a dispassionate, loyal way to warn the Secretary of the Department," the report said.

"She was absolutely correct in the points she made, but they were highly inconvenient, and they were never going to be received in the spirit in which they were delivered."

Questions over validity

The report also addressed the difficulty of ascertaining at what point "the Australian government" knew or should have known the debts raised by the scheme may not have been valid.

It found that some DHS senior executives had always known it, and some Department of Social Services senior executives must have suspected it "at least by 2016".

"As to members of the Government, one Minister, (then-Social Services Minister Scott Morrison), took the proposal to Cabinet, knowing that it involved income averaging and that his own Department had indicated that it would require legislative change, but on the basis of the contrary indication in the NPP checklist, proceeded without enquiring as to how the change had come about," the report read.

"There was no reason for any other member of Cabinet, however, to question the proposal, because it was devoid of any indication that income averaging was involved or that there was any issue of legislative authority.

"However, the question of who knew what changed in 2017.

"There were plenty of indications that income averaging without other evidence was not a legitimate way of calculating entitlement," the report said.

"The shaky legal underpinnings of the system were being identified by journalists and academics."

Reaction

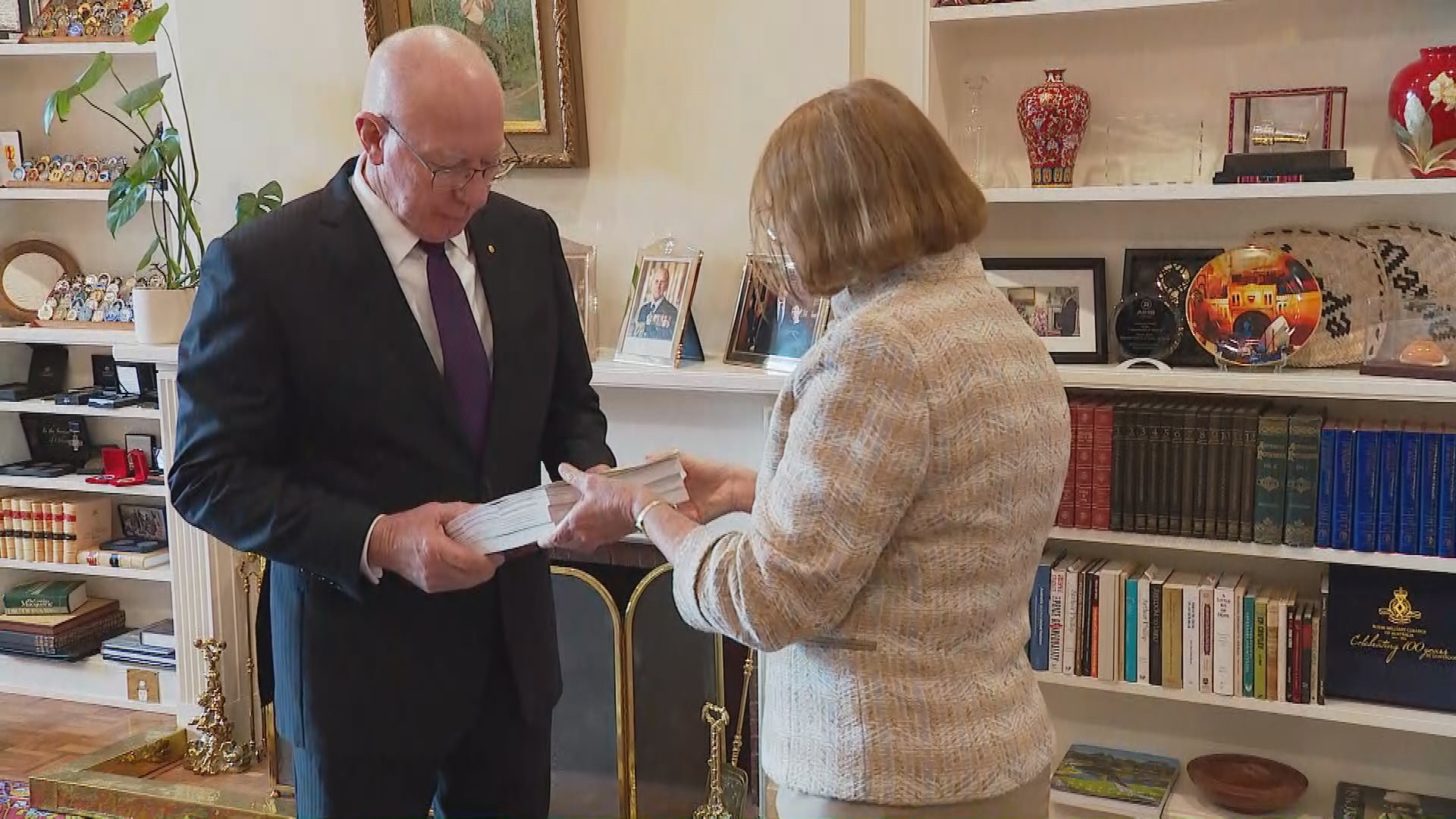

Prime Minister Anthony Albanese apologised to the thousands of individuals harmed by the robodebt scheme while slamming the former government for the "gross betrayal and human tragedy" caused by the scandal.

"We have arrived at the truth because of the courage of some of the most vulnerable Australians," he said in a media conference after the report was delivered.

"People who have shown bravery in the face of injustice, hardship and sometime sterrible grief."

He condemned the former government over the scheme and slammed opposition ministers who sought to "shift the blame, bury the truth and carry on justifying the shocking harm".

Albanese said it was wrong and illegal to have sought debt against Australians who had no debt to pay."It should never have happened and it should never happen again," he added.

Not only did the report condemn the human toll of the scheme but the actions and roles of government ministers involved in robodebt.

Albanese noted the commission's findings on Morrison and Alan Tudge's failure to meet their ministerial responsibilities to alert the failings and problems of robodebt.

READ MORE: Australian airports plunged into chaos

The robodebt scheme ran for four-and-a-half years, from July 2015 to November 2019, during which time $1.73 billion in unlawful debts were raised against more than 400,000 people.

A class action lawsuit over the scheme was settled for $1.2 billion in 2020.

A further $721 million in wrongly issued debts was repaid.

Robodebt victims told of being pushed to the brink of suicide after being chased by debt collectors.

Speaking to 9news.com.au in 2020, Sunshine Coast mother Jennifer Miller said her son, Rhys Cauzzo, took his own life on Australia Day in 2017 after he was given two debts by Centrelink.

His suicide followed months of being hounded by debt collectors.

Queensland mother Kath Madgwick lost her only child, son Jarrad to suicide.

The 22-year-old took his life hours after finding out he had a Centrelink debt of $2000 in May 2019.

Madgwick last year said she was "delighted" to hear news of the royal commission today, adding that she hoped it would bring closure for herself and others who had lost their closest loved ones.

KEY DETAILS OF THE REPORT

- A royal commission report into the robodebt scheme has been tabled in parliament and made public

- The report by royal commissioner Catherine Holmes, SC, makes 57 recommendations, including the referral of individuals for civil and criminal prosecution

- Robodebt was "a crude and cruel mechanism, neither fair nor legal, and it made many people feel like criminals", the report found.

- It was also "a costly failure of public administration, in both human and economic terms".

- Robodebt was an unlawful method of debt assessment used by Services Australia under the Coalition federal government from 2016-2020

Readers seeking support can contact Lifeline on 13 11 14 or beyond blue on 1300 22 4636.

Sign up here to receive our daily newsletters and breaking news alerts, sent straight to your inbox.