In pursuit of the ambitious goal of reaching net-zero emissions, nations worldwide must expand their use of clean energy sources. In the case of solar energy, this change may already be upon us.

The cost of electricity from solar plants has experienced a remarkable reduction over the past decade, falling by 89% from 2010 to 2022. Batteries, which are essential for balancing solar energy supply throughout the day and night, have also undergone a similar price revolution, decreasing by the same amount between 2008 and 2022.

These developments pose an important question: have we already crossed a tipping point where solar energy is poised to become the dominant source of electricity generation? This is the very question we sought to address in our recent study.

Our findings, which were obtained by plugging the latest technological and economic data from 70 regions across the globe into a macroeconomic model, suggest that the solar revolution has, indeed, arrived. Solar energy is on track to make up more than half of global electricity generation by the middle of this century – even without more ambitious climate policies.

This projection far exceeds any previous expectations. In 2022, the International Energy Agency’s World Energy Outlook report predicted that solar energy would account for a mere 25% of electricity production by 2050.

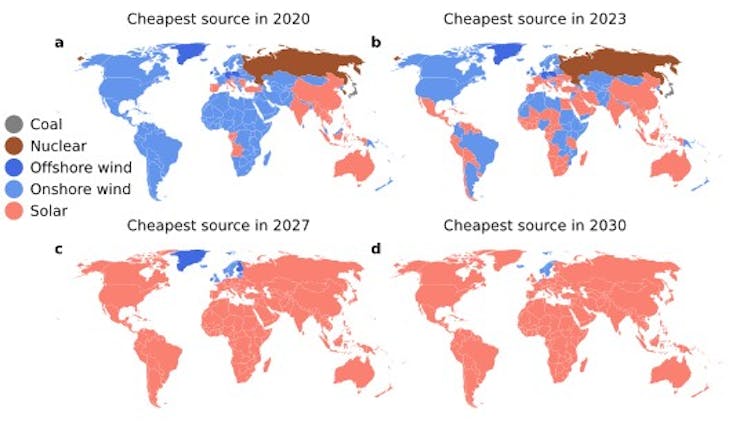

Solar and storage cheapest by 2030

We identified two key factors that will drive the rapid expansion of solar energy: its affordability and swift construction timeline. The construction of a solar farm usually takes just one year to complete. In comparison, offshore wind farms can take up three years to construct.

The faster construction of solar farms allows investors to take advantage of their cost-effectiveness sooner than they would be able to do with offshore wind farms (and many other renewable energy infrastructures).

We see the interplay of these factors forming a self-reinforcing cycle. As producers and installers gain more experience, prices are projected to continue their decline. This will render solar energy an even more attractive prospect for investors.

Our projections suggest that the average cost of generating electricity through solar energy will decrease substantially, by 60% from 2020 to 2050, even when factoring in the growing demand for energy storage.

Should these forecasts prove accurate, solar energy combined with storage is expected to become the cheapest option for generating electricity in nearly all regions worldwide by 2030. In that same year, it is expected to be 50% less costly than constructing new coal-fired power plants in six major regions: the EU, US, India, China, Japan and Brazil.

Countries that continue to construct fossil-based infrastructure run the risk of putting their electricity-intensive sectors at a significant competitive disadvantage. Consequently, we must question whether it is realistic to rely on fossil fuels for the power sector. The future appears to be beckoning in a more sustainable direction.

Solar is becoming the cheapest option for generating electricity

But barriers remain

The rapid expansion of solar is very likely, and could lead to exceptionally affordable electricity. However, several hurdles must be overcome to ensure that solar’s ascent can be sustained.

Solar energy is highly variable, dependent on factors like the time of day, season and weather conditions. To accommodate this variability, electricity grids must be designed with flexibility in mind. This will require extensive energy storage, an expanded network of transmission cables linking different regions, and more investment in complementary renewable energy sources like wind.

In a future where solar energy dominates, there will also be a substantial demand for various critical metals and minerals. In fact, the International Energy Agency predicts that, by 2040, renewable technologies will account for approximately 40% of the total demand for copper, between 60% and 70% for nickel and cobalt, and nearly 90% for lithium.

To ensure a steady future supply of essential materials, recycling initiatives will have to be developed further. Global mining activities must be diversified too. This will help spread the risks associated with concentrating mining activities in unstable regions.

Access to financial resources is a critical factor in sustaining the growth of solar. But, at present, the bulk of climate-related funding is concentrated in developed or emerging economies.

Between 2011 and 2020, 75% of all climate finance was channelled into North America, western Europe and east Asia (primarily led by China). Africa, one the other hand, received only 5% of total global climate finance over the same period.

One potential avenue to bridge this funding gap is the implementation of mechanisms that absorb currency and investment risks in developing countries, thereby unlocking international capital flows.

The solar revolution has arrived. Countries and regions that do not incorporate renewables into their energy risk losing their competitive edge, particularly within their industrial sectors. To remain at the forefront, nations should not just maintain their current progress but rather accelerate their efforts to integrate solar energy into their grids, supported by investments in complementary technologies.

By doing so, they can avoid the looming risk of new coal and gas plants becoming obsolete and financially burdensome stranded assets. The sun is rising on a new era of energy – the time to embrace it is now.

Don’t have time to read about climate change as much as you’d like?

Get a weekly roundup in your inbox instead. Every Wednesday, The Conversation’s environment editor writes Imagine, a short email that goes a little deeper into just one climate issue. Join the 20,000+ readers who’ve subscribed so far.

![]()

Nadia Ameli receives funding from the European Research Council (ERC) under the European Union’s Horizon 2020 research and innovation programme (grant agreement No 802891).

Femke Nijsse receives funding from the Children's Investment Fund Foundation and the Department of Net Zero and Energy Security.

Jean-Francois Mercure previously received funding from the UK's Department for Business, Energy and Industrial Strategy, UKRI, Horizon Europe and the Children's Investment Fund Foundation. He currently works at the World Bank using funds from the German Department for International Development (GIZ) under the Climate Support Facility.