Australia's inflation problem is "increasingly homegrown", the Reserve Bank chief has declared, meaning it will take longer to bring under control and likely require further interest rate pain.

On Wednesday night, governor Michele Bullock pointed to the rapidly rising cost of trips to the hairdresser, dentist and restaurants as one piece of evidence that price increases were being driven locally.

It was a different scenario to recent years when a lack of supply was the "most prominent driver of the initial surge in inflation around the world".

READ MORE: Two women rescued on floatie out at sea in Western Australia

"Pandemic-related supply chain problems occurred at the same time as demand for goods was strong, resulting in a sharp increase in prices for many goods," Bullock said.

"Then, as the pandemic's effects on supply chains were starting to ease, Russia's invasion of Ukraine led to spikes in energy and some food prices.

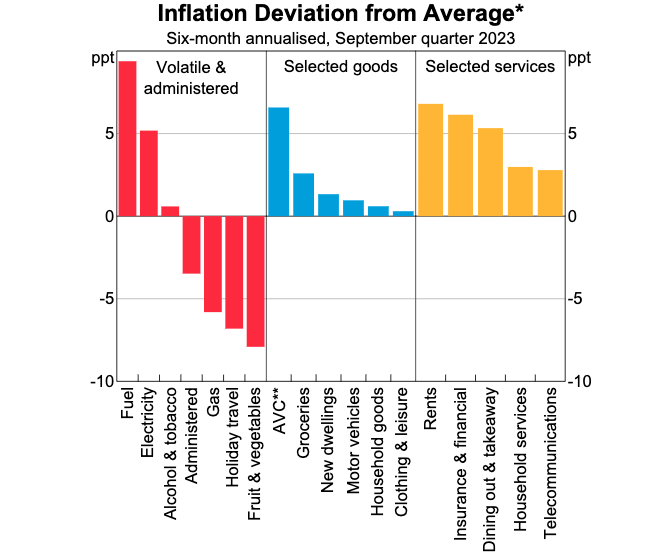

"Headline inflation around the world is now declining as goods price inflation is continuing to ease and the energy price rises have unwound, and this process has a bit further to run."

In Australia, the shift from supply issues to rising demand was slowing the fight against inflation and getting it back to the RBA's target range of 2-3 per cent would take some time, Bullock said.

The measure dropped from 8 per cent to 5.5 per cent in three quarters but the bank expected it would take two more years to fall below three per cent.

Wages, business rents and energy were all going up, while unemployment remained low, the governor said, as further evidence of domestically driven inflation.

READ MORE: Network Ten 'utterly destroyed' Bruce Lehrmann's reputation, court told

Fresh food and holiday travel were one of the few bright spots where prices had fallen.

That leaves the RBA falling back on its trusty "blunt tool" – interest rates – to "slow the growth of demand enough to bring inflation back to target while keeping employment growing".

"I know that my message tonight will not resonate with some," Bullock said.

"I receive letters from people who are finding it difficult to make ends meet and I speak with organisations that assist struggling households.

"Everyone is seeing prices for goods and services rise strongly but this has a particularly severe impact on low-income households.

"This emphasises the need to get inflation back down."

READ MORE: Emergency warning issued as bushfire threatening lives and homes in Perth

READ MORE: Investigators find pipe bomb, booby traps and murder plot inside US man's home

The latest cash rate hike – to 4.35 per cent – pushed the minimum wage to comfortably afford a mortgage for the average house, which now costs almost $1 million, to $182,000, according to finder.

Experts are increasingly warning further hikes could push many homeowners to or over the brink.