The latest UK consumer price index (CPI) data has been hailed as a win for prime minister Rishi Sunak’s aim to half inflation, announced earlier this year. Prices rose by 4.6% in October 2023, bringing the rate of price growth down to its lowest point since an October 2022 peak of 11.1%.

But inflation coming down gradually does not mean prices are falling – they are merely increasing at a slower pace. Prices remain high, deepening the cost of living crisis for many, especially those whose nominal wages have not increased at pace with inflation in recent years.

Compounding this, poor households spend a bigger proportion of their income on food, energy, and rent – three costs that have spiked the most in recent years, and still remain high.

A decline in energy prices was the biggest contributor to the recent inflation slowdown. But even though electricity, gas and other fuel costs have fallen by 21.7% since October 2022, these prices remain very high.

Gas prices are about 60% higher than they were in October 2021 and the price of electricity is about 40% higher. Compared to January 2021, electricity, gas and other fuel costs are currently 82% higher.

Annual inflation in the price of food and non-alcoholic beverages is also still high at 10.1%. October 2023 food prices were around 30% higher than in October 2021, while private rents are up by 11.5% compared to January 2021.

The government’s fears of a wage-price spiral – its reasoning for holding out against public sector strikes for so long – have also failed to materialise.

An adequate increase in public sector pay in health, education and the civil service would have reversed decades of below-inflation pay for these workers. And public sector wages do not directly lead to rising input costs for private companies, and so would have done little to fuel a wage-price spiral.

Read more: Strikes: why refusing public sector pay rises won’t help reduce inflation

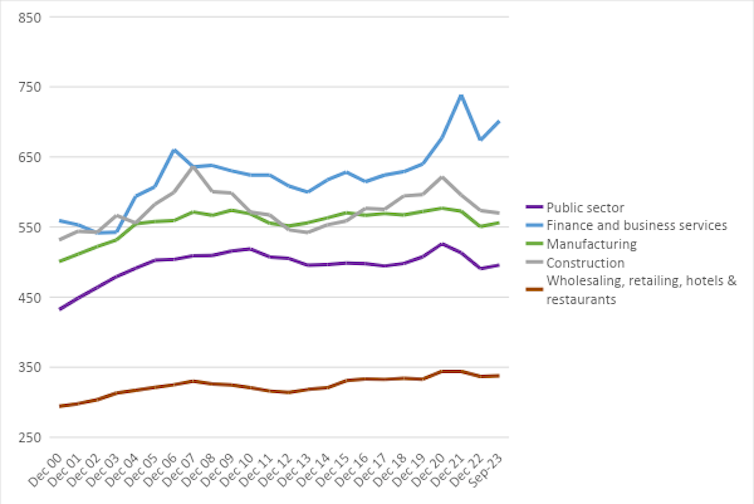

Recent wage disputes and high job vacancy rates have delivered only modest increases in real pay in the public sector (1.4%). Wages have stagnated in manufacturing and wholesaling, retailing, hotels and restaurants sectors, and fallen in construction (by 2.8%) as of September 2023 compared to September 2022.

The only sectors that saw a substantial real pay rise are finance and business services (2%) and transport and storage (15.8%). In fact, real wages remain below pre-pandemic levels in all other sectors.

Wages are stagnant or falling in some sectors:

Boosting profits

Meanwhile, some firms have added the rising costs of inputs like energy and food into the price of the goods they sell, squeezing the poorly-paid from the other side. Some have even increased their profit margins since 2021 by raising prices at a faster rate than the increase in their input costs.

A Bank of England survey shows many of the firms with the highest profit margins are expected to increase their profit margins further in 2023, while firms with the lowest profit margins reported a drop in 2022, and are only expected to see a partial recovery this year.

Wages could increase without causing higher inflation if the top firms cut their profit margins. This would also help the firms who were not able to pass on high input, wages or borrowing costs to their customers. With company insolvencies at a 14-year high, they are instead cutting back non-essential spending.

But the government has done little to address the rise in profit margins for the top companies beyond a limited energy price cap and windfall taxes on energy companies. As food prices soared, government intervention amounted to meetings with the farmers, food producers and some of Britain’s largest supermarkets to discuss capping price increases in 2023 without actual price controls.

Read more: Six ways the upcoming autumn statement could affect your personal finances

Chancellor Jeremy Hunt’s upcoming autumn statement is unlikely to offer many solid solutions to tackle the cost of living crisis or problems with public physical and social infrastructure. Hunt is expected to stick to the narrative that a reduction in public debt/GDP is essential to fight inflation.

Similarly, the Bank of England may hold interest rates again at its next Monetary Policy Committee meeting in December, despite stagnation in consumer demand and business investment.

These policies will not help to address the multiple intersecting crises facing the UK right now, including inequalities in class, gender and race, ecological breakdown, geopolitical turmoil and technological change – not to mention the ongoing cost of living crisis.

![]()

Özlem Onaran received funding from ESRC Rebuilding Macroeconomics, International Trade Union Confederation, Women’s Budget Group, American University, the Institute for New Economic Thinking, the Foundation of European Progressive Studies, the Vienna Chamber of Labour, and Unions21.