A new poll released today shows that many Australians are feeling fearful on the cost-of-living front amid falling support for the Labor federal government.

The findings of the survey, published in The Sydney Morning Herald, and The Age, will be a wake-up call for Prime Minister Anthony Albanese as he returns to parliament today after visits to the US and China.

Only 8 per cent of voters are expecting the economy to improve in the next three months, while 50 per cent believe it will get worse, according to the research.

READ MORE: Rail delays in Melbourne as passengers abscond from delayed train

And many voters appear to blame the Labor government for the economic woes caused by higher interest rates and steeper mortgage repayments.

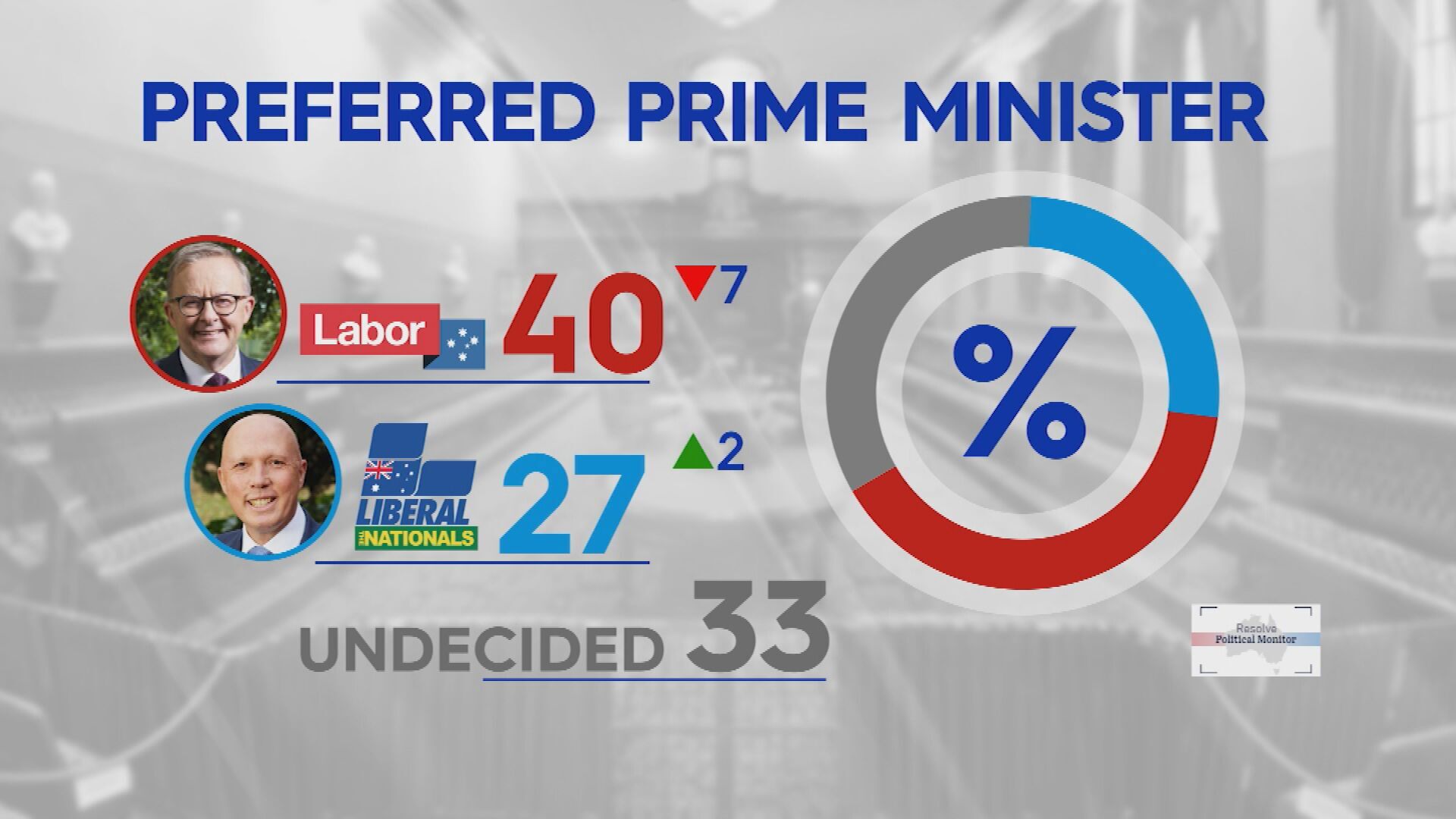

Albanese has slipped as preferred prime minister, dropping seven points to 40 per cent since last month, but he remains well ahead of Opposition Leader Peter Dutton who is on 27 per cent.

Labor strategists will no doubt note that Dutton has regained support this year, narrowing the gap between the two leaders to its closest point since the election last May.

But voters in substantial numbers have not switched to the Coalition. Its core support is now at similar levels to that in January (29 per cent).

READ MORE: Workmates believed to be victims of Victorian crash

The Resolve Political Monitor polled 1602 eligible voters from November 1 to 5 when the Middle East war and the Prime Minister's visits to the US and China dominated headlines.

Resolve director Jim Reed said the results showed Labor was struggling to fulfil expectations it could fix the cost-of-living crisis.

"Economic management has traditionally been a Coalition strength, and we've seen that return to type over the last few months," he said.

It was also carried out only days before the Melbourne Cup Day interest rates hike last week when the Reserve Bank lifted them to a 12-year high of 4.35 per cent.

After four months of stability at 4.10 per cent, the central bank chose to lift the cash rate to 4.35 per cent in a bid to tackle enduringly persistent levels of inflation.