The energy transition is not on track to mitigate the effects of climate change. Take the case of Shell, whose shareholders recently voted to decelerate the UK-based oil giant’s climate targets. Shell had planned to cut its “net carbon intensity” by 20% by 2030 and 45% by 2035, but now seeks a 15%-to-20% reduction by 2030 and no longer has a 2035 target.

Shell CEO Wael Sawan told shareholders this was motivated by “uncertainty around the pace of change in the transition”. BP is also scaling back its climate commitments, despite previously being one of the industry’s early movers in setting green priorities.

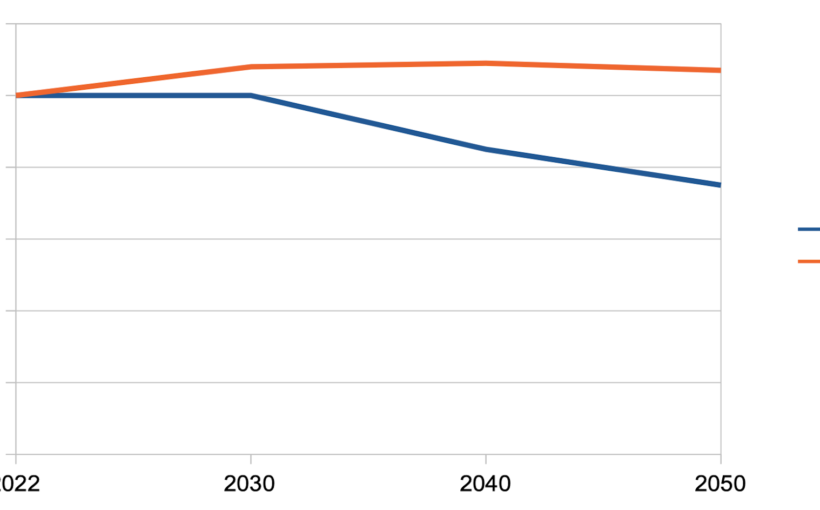

One important explanation for these shifts is that world demand for fossil fuels keeps rising, reflecting development needs and population growth in the global south and also governments’ failure to keep net-zero targets on track. Oil demand is set to hit nearly 103 million barrels per day in 2024, compared with 100 million in 2019 and 85 million a decade earlier. In 2025, it is expected to cross 104 million barrels.

The US majors – Chevron, ConocoPhillips, ExxonMobil – have done a better job of foreseeing this than their European counterparts, Shell), BP and TotalEnergies. The US majors’ more bullish forecasts have led them to take a different approach to the energy transition, prioritising decarbonising their products rather than diversifying into renewables and associated cleantech, per the Europeans.

Oil demand projections from BP and ExxonMobil

Environmental activists have treated the US majors as pariahs for refusing to scale back their core businesses. Activists hardly embrace the European majors either, but it has seemed self-evident that their diversification efforts would contribute more to the energy transition than the US majors. This looks debatable, however.

Diversify or die?

If you believe that demand for fossil fuels will be reduced by government climate policies, it follows that the oil majors are in a fight for survival. They risk being put out of business by billions of dollars-worth of “stranded assets” on their balance sheets, such as oil reserves and production infrastructure whose values could collapse.

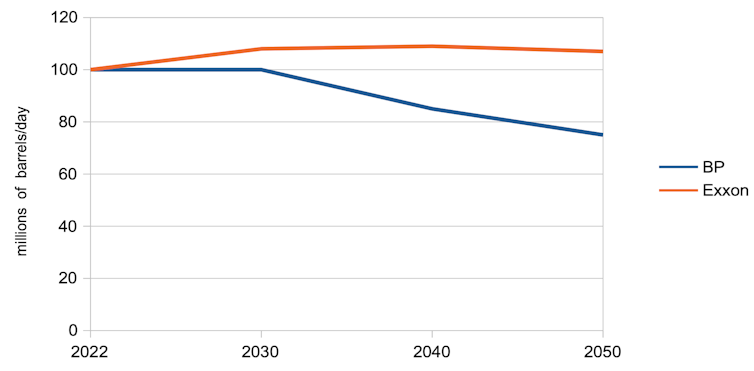

Many policymakers and climate advocates in Europe and North America have been arguing this for some time, using metrics that rank these multinationals on their “readiness” for the transition. Yet despite impressive increases in solar and wind capacity, 55% of global energy remains supplied by oil and gas (plus 27% from coal).

Global energy consumption by source

From a commercial perspective, the American majors’ more determined focus on their core oil and gas business has been rewarded. ExxonMobil’s earnings have been smashing estimates, for instance. As CEO Darren Woods put it in early 2023: “We leaned in when others leaned out, bucking conventional wisdom.”

A substantial gap in US-European share price valuations exists, as shown in the chart below (click to make it bigger). In the UK, lower valuations are also due to a general decline in London stock market values – the CEOs of Shell and TotalEnergies have both openly considered switching listings to the US. Shell and BP’s decisions to moderate their climate targets are to a similar end.

Oil majors’ price-to-earnings ratios

The strategic divide

Since 2021, BP has ploughed 8%-to-12% of annual capital expenditure (capex) into renewables, mainly offshore wind and charging infrastructure for electric vehicles (EV). Shell focuses mostly on solar and wind, spending 12%-15% of capex over the same period. This amounts to annual spending of over US$1 billion (£784 million) for BP and around US$3 billion (£2.4 billion) for Shell.

The US majors are spending comparably on decarbonisation. ExxonMobil has earmarked US$20 billion or 17% of capex from 2022-27, including carbon capture, lithium mining, hydrogen and biofuels. Chevron’s planned spend is US$10 billion or 12.5% of capex by 2028 on similar activities.

To be clear, these efforts don’t meet expectations. The International Energy Agency (IEA) thinks that to hit net-zero emissions, oil majors must spend 50% of capex by 2030 on clean energy (be it renewables or decarbonisation). A mere 2.5% was spent in 2022, partly because the national oil companies that produce most of the world’s oil and gas spend even less than the US-European majors.

Decarbonisation is probably the best spending choice, given that oil demand is rising. Also, building wind and solar farms is arguably a poorer fit for the majors’ core skillset – contrast, for example, ExxonMobil’s move to become a leading lithium producer for EV batteries, which fits its drilling specialism.

At any rate, the majors will only raise transition-spending if they’re convinced it’s in their interests. Much depends on incentive structures, which haven’t always been helpful.

The US majors (and environmental activists) have complained in the past that US incentives to decarbonise have been inadequate and government policy unpredictable. The 2022 US Inflation Reduction Act (IRA) has improved the situation by incentivising investments through tax credits.

EU efforts to produce a comparable package are lagging. It doesn’t help that the war in Ukraine and post-pandemic economic woes have intensified European concerns about energy costs and security.

In addition, Philippe Ducom, CEO of ExxonMobil Europe, recently claimed that the array of different EU regulations in different member states inhibits green investment. He said this currently makes it difficult to spend any of the firm’s US$20 billion decarbonisation fund in Europe.

Clearly, the EU needs to both agree on IRA-style incentives and harmonise regulations urgently. Equally, the US needs to ensure that the IRA incentives go far enough if the majors are to come anywhere close to the IEA 50% capex target.

Notwithstanding the majors’ determination to keep supplying more oil, it’s time for policymakers to view them as a crucial piece of the energy-transition puzzle. If these firms can be incentivised to invest more of their considerable cash flow – precisely what renewables companies lack – into decarbonisation, the impact will be significant.

The US majors’ superior valuations and performance mean they have the most investment capability. With the US political and economic environment also more conducive to letting them do what they do best, ironically they could well end up contributing more to the green transition than their European counterparts.

![]()

Stefan Andreasson owns shares in Shell.