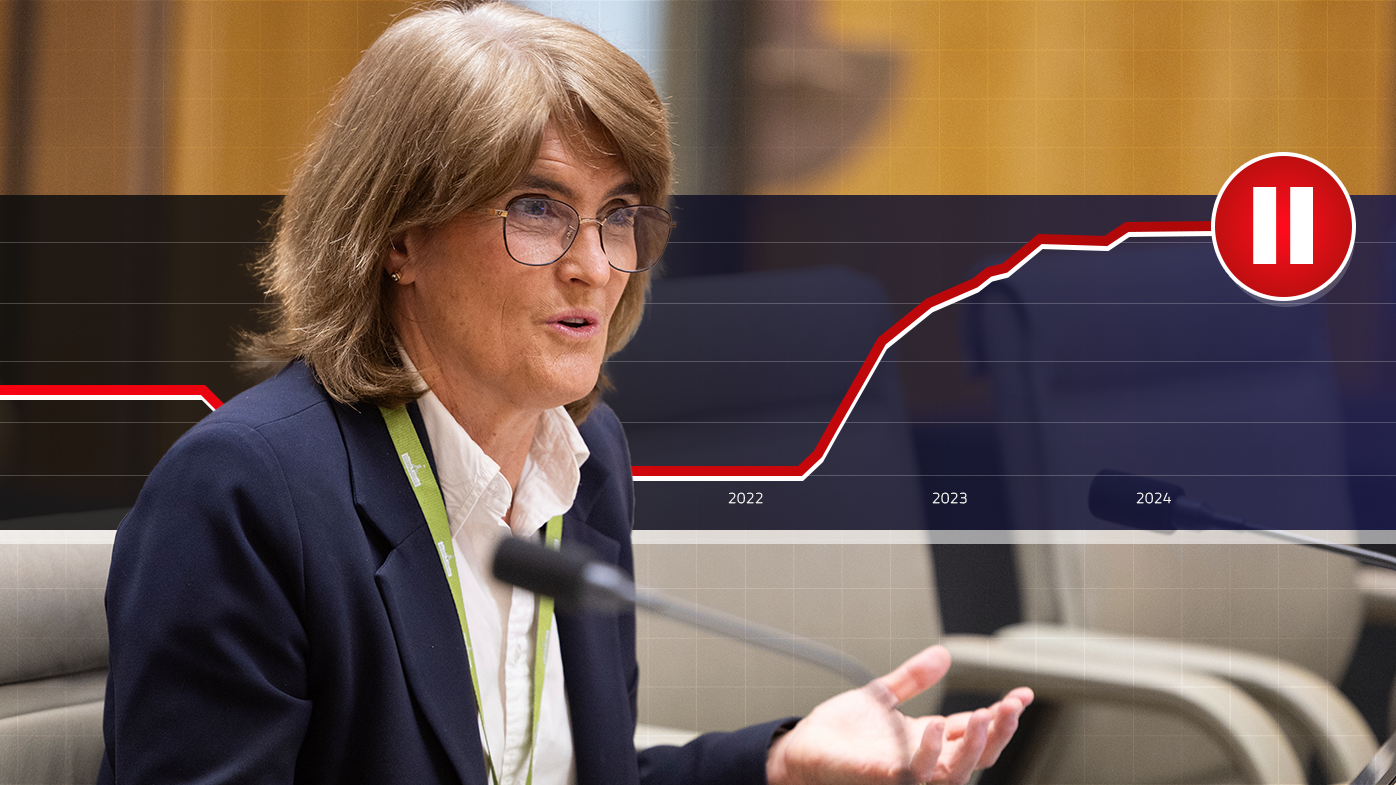

Australia's central bank has kept interest rates on hold for a fifth consecutive meeting as thousands of households anxiously rate for a long-heralded cut.

Announcing its decision today, the Reserve Bank of Australia (RBA) board said it would keep the cash rate target on hold at 4.35 per cent.

The current rate, the highest since September 2011, has been unchanged since November 2023.

READ MORE: Philanthropist who gave away millions dies

In its monetary statement the RBA board said it was deeply aware of the current financial conditions affecting Australian households – but more data was needed before moving on rates.

"There is uncertainty around consumption growth. Real disposable incomes have now stabilised and are expected to grow later in the year, assisted by lower inflation and tax cuts," Bullock said.

"There has also been an increase in wealth, driven by housing prices. Together, these factors are expected to support growth in consumption over the coming year.

"But there is a risk that household consumption picks up more slowly than expected, resulting in continued subdued output growth and a noticeable deterioration in the labour market."

Despite this, the board refused to be drawn on when rates would be cut – or if they would be cut at all.

"While recent data have been mixed, they have reinforced the need to remain vigilant to upside risks to inflation," the monetary statement reads.

"The path of interest rates that will best ensure that inflation returns to target in a reasonable timeframe remains uncertain and the Board is not ruling anything in or out."

READ MORE: Secret Service agent robbed at gunpoint in US

Graham Cooke, head of consumer research at Finder, said the decision might feel like a punch in the gut for homeowners holding out for a rate cut.

"With inflation showing little signs of rapid decline, hopes of a rate cut to ease the pressure on household budgets seem further away," he said.

"Rising costs are relentless, eating away at savings and squeezing wallets, causing genuine financial pain for many."

Anneke Thompson, chief economist at CreditorWatch, said she anticipates the next move for the RBA is a rate cut – but that might not come until next year.

"Given the stress facing Australian households, both mortgaged and renters, as well as many small and medium-sized businesses, we feel it is unlikely the RBA will move the cash rate higher from here," Thompson said.

"Rather, the likely scenario is for the RBA to maintain the pressure on prices by keeping the cash rate at 4.35 per cent into early 2025, and only reducing it once the impact of lower migration levels begin to impact services inflation."

READ MORE: Politicians get second-biggest pay raise in last decade

Steve Mickenbecker, Canstar's group executive of financial services, said stickier than expected inflation is pushing out the forecast timelines at most major lenders.

"In bad news for borrowers ANZ Bank has pushed out its projection for a first cash rate cut to February 2025 in reaction to slower than expected progress of inflation towards the 2 to 3 per cent RBA target band," he said.

"The other big banks are sticking to November 2024 for now.

"The slower trajectory towards the Reserve Bank inflation target band is reflecting in higher term deposit interest rates, with nine banks increasing 21 rates by an average of 0.41 per cent.

"There's not much in the way of good news for borrowers, as the two lenders cutting interest rates last week were countered by three bumping them up."