Getting on the property ladder has never been tougher, according to a new report which is sobering reading for thousands of would-be first-home buyers.

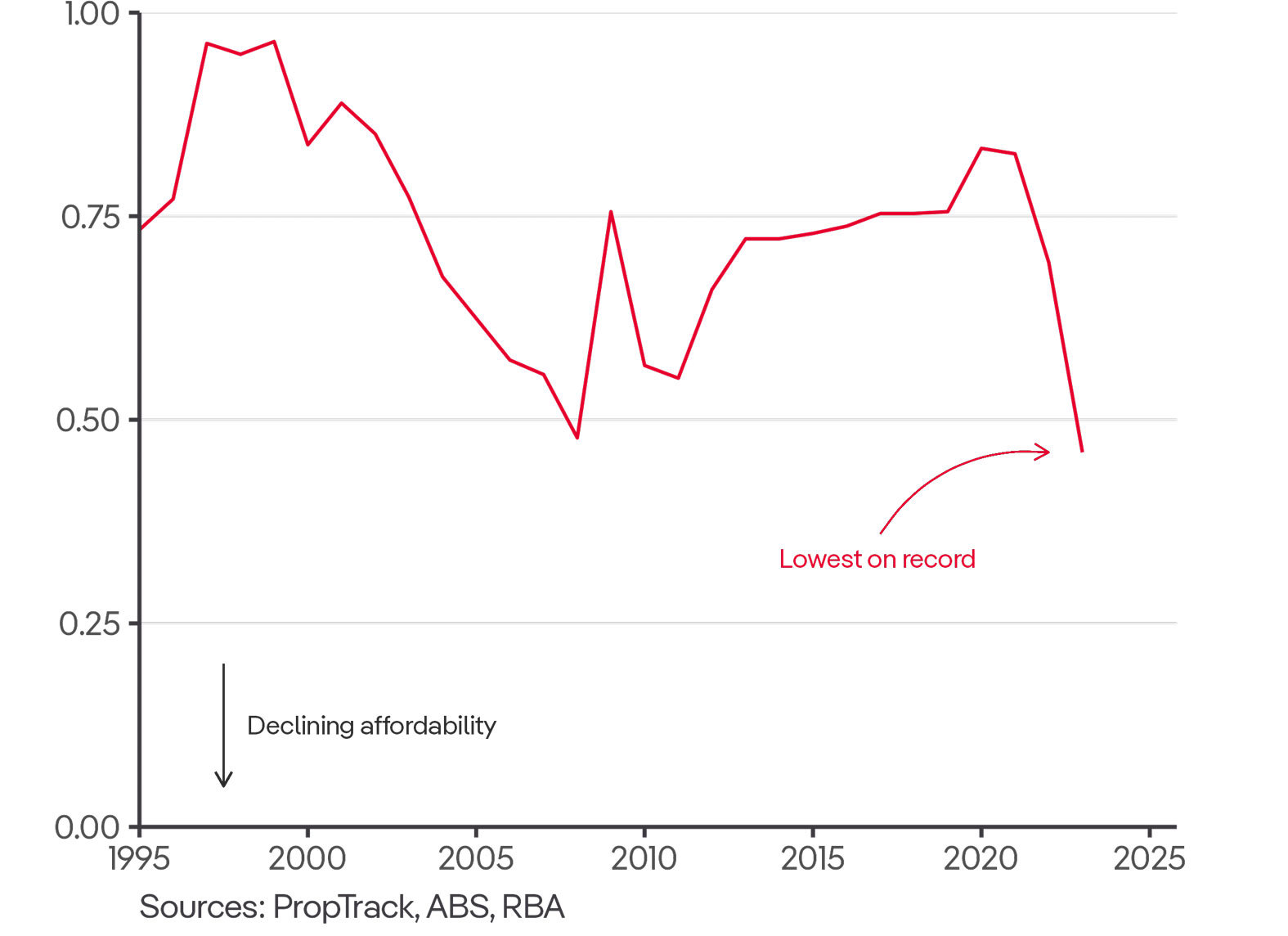

New figures from PropTrack show surging home prices through the pandemic and rapidly rising interest rates over the past year have brought housing affordability to its lowest level in at least three decades.

Highlighting an "alarming state of housing affordability", the report showed a household earning the median income can now afford just 13 per cent of homes sold across the country.

READ MORE: Fears avalanche of Aussie layoffs coming

This is the lowest share since PropTrack records began in 1995, and the company described it as "a substantial change" compared to the past few years.

Even high-income households, earning $200,000 a year, which is more than 80 per cent of Australians, are facing strained affordability, the report said.

These richer households can afford loan repayments on only about half of homes that were sold over the past year, based on current market conditions.

Are you affected? Are you a despairing would-be homeowner? Email [email protected]

With a median home price exceeding $1 million in Sydney, New South Wales continues to rank the least affordable state, as it has for most of the past three decades.

Victorian housing affordability remains below the national average and has recorded "significant deterioration" over the past 12-18 months as interest rates have increased.

Similarly, Tasmania has suffered sharply lower affordability recently.

In 2018 and 2019, the index ranked Tasmania as one of the most affordable states.

But since 2019 prices have surged, rising by more than 50 per cent in Hobart, and 70 per cent in regional Tasmania.

The report said the nationwide data showed how first-home buyers were disproportionately affected by current market conditions.

READ MORE: One dead as floods trap thousands at Burning Man festival

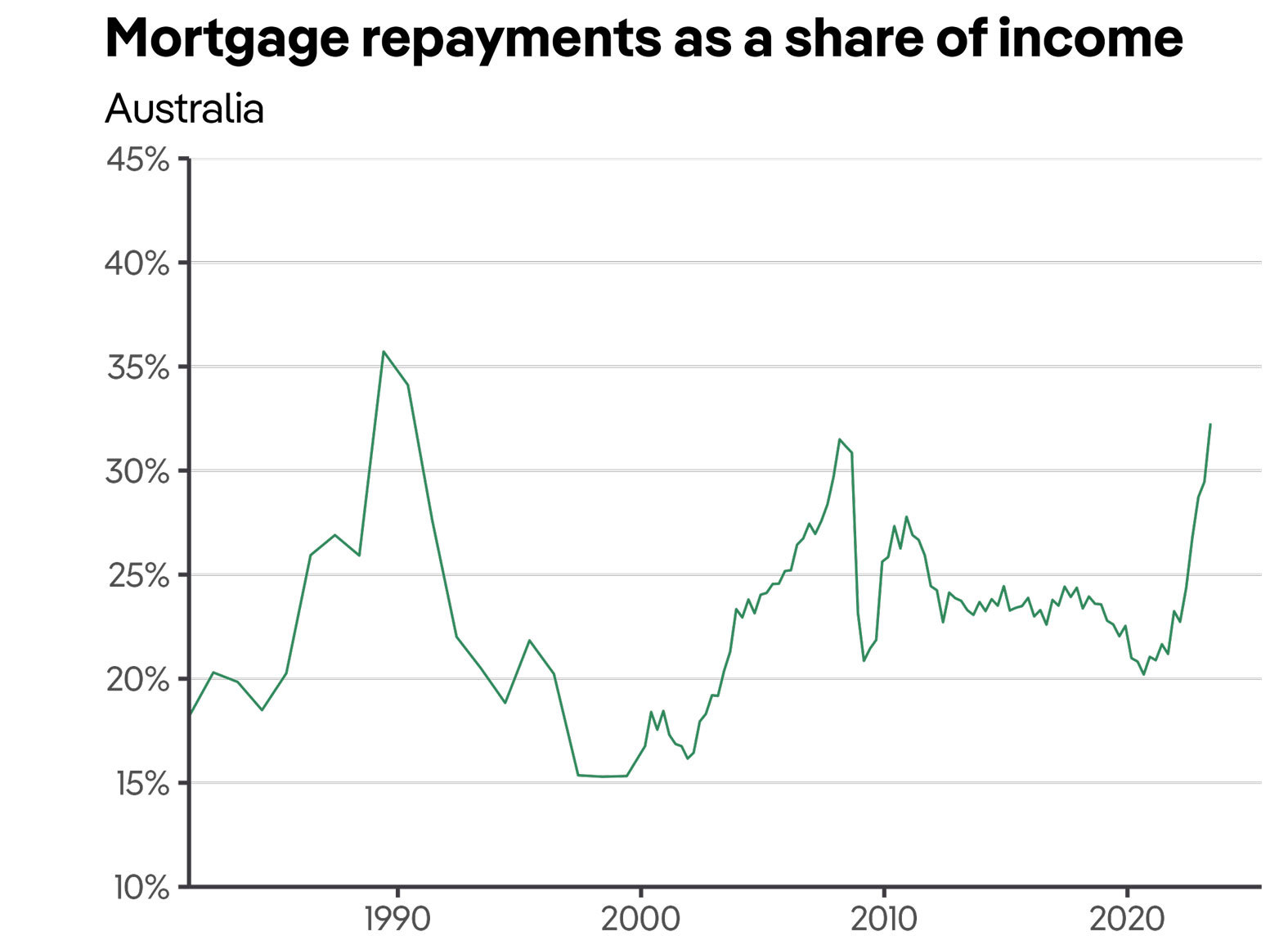

Mortgage interest rates have increased dramatically over the past year, following record lows in 2020 and 2021.

The hiking phase has pushed the cash rate target from 0.1 per cent to 4.1 per cent, and caused the sharpest rise in mortgage rates since the mid-1980s.

"Servicing a mortgage is close to as hard as it has ever been, just below the peak reached in 1989," the report said.

"A household earning average income would need to spend about a third of their income on mortgage repayments to buy a median-priced home.

"That represents the highest level since 1990, exceeding the most recent peak set in 2008."

READ MORE: Vandals chop down and kill 265 trees near affluent Sydney waterfront street

High home prices mean saving a deposit is a key barrier for first-home buyers.

An average-income household would need to save 20 per cent of their income for more than 5.5 years to save a 20 per cent deposit on a median-priced home, the report said.

Research released last week showed a record number of Aussies are suffering from mortgage stress, with around 1.5 million mortgage holders now deemed "at risk".

The Reserve Bank is scheduled to make another rates decision tomorrow, the last for outgoing governor Philip Lowe.