As sea levels rise, more than half of all Australian homes have been left uninsurable due to their risk of coastal flooding and erosion, new research by Monash University and AON has found.

The report found about 370,000 residential homes and 120,000 commercial properties are excluded from most insurance policies due to what's called the "actions of the sea".

"This essentially refers to erosion or flooding experienced on the open coast, resulting from storm tide or wave action," the report wrote.

READ MORE: New Zealand city's weird green vehicle has now been identified

"In some cases, it will include storm surge from tropical cyclones."

Almost 500,000 properties have a one per cent risk of coastal flooding in any given year.

While one per cent doesn't sound like much, it's equivalent to a one in four chance within the typical lifetime of a mortgage of 30 years.

"These at-risk properties will not have insurance coverage for actions of the sea, and the risk will lie with the property owner," the report said.

Australia's sea levels are rising largely on par with the global average of about 0.2 metres since the start of the 20th century.

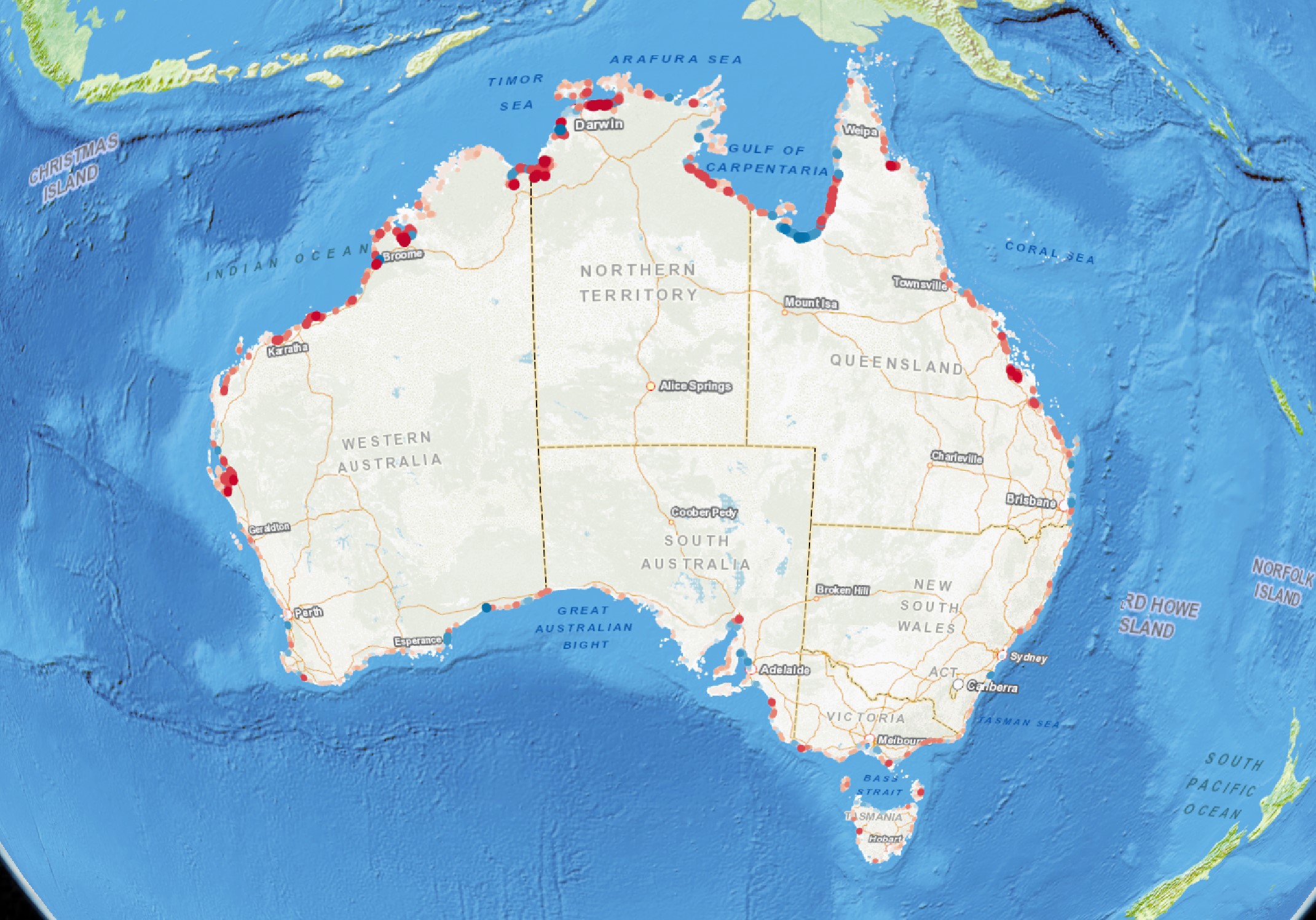

DEA Coastlines is mapping our coastal erosion.

Areas that have had the worst erosion of more than five metres include Old Bar in New South Wales, Waratah Bay in Victoria, Rockhampton in Queensland, Glenelg in South Australia, Broome in Western Australia and Shoal Bay in the Northern Territory.

READ MORE: Two people trapped after ice cave collapses during tourist tour in Iceland

Australia also faces variables impacting the coast like ocean dynamics, heat, vertical land motion and the earth's gravitational field.

The world's sea levels are forecast to rise to 0.44 metres to 0.77 metres by the year 2100.

"The largest driver of present-day sea level rise is thermal expansion – the increase in ocean volume as it warms," the report said.

"However, with increasing ocean and atmosphere warming, melt from glaciers and the Antarctic and Greenland Ice Sheets is accelerating."