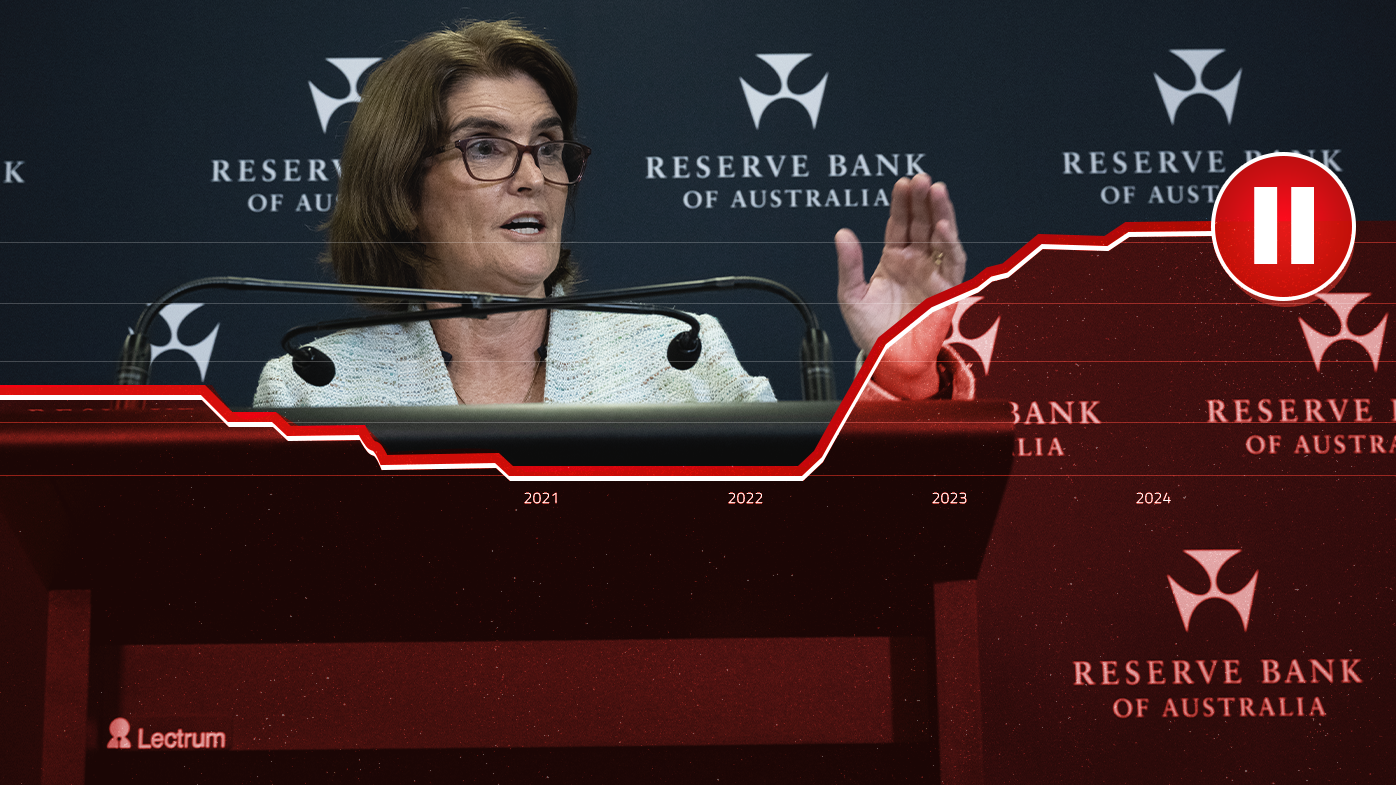

The Reserve Bank of Australia (RBA) has kept interest rates on hold at 4.35 per cent, a day after wild market swings saw billions of dollars wiped from the global economy.

Completing its two-day meeting today, the RBA board decided to leave the official cash rate target as-is, despite the looming prospect of high inflation becoming entrenched.

Today's decision marks the sixth consecutive time the central bank has left rates on hold since November 2023.

EXPLAINED: When are interest rates going to fall?

In its Monetary Policy Decision Statement, the RBA board said it was closely watching the development of global economies such as the US, where fears of a recession yesterday saw more than $100 billion wiped off the local ASX 200.

"The economic outlook is uncertain and recent data have demonstrated that the process of returning inflation to target has been slow and bumpy," the board said.

"The Board will rely upon the data and the evolving assessment of risks to guide its decisions.

"In doing so, it will continue to pay close attention to developments in the global economy and financial markets, trends in domestic demand, and the outlook for inflation and the labour market.

"The Board remains resolute in its determination to return inflation to target and will do what is necessary to achieve that outcome."

READ MORE: Mortgage holders reducing monthly repayments adding years to borrowing term

Graham Cooke, head of consumer research at Finder, said borrowers are desperate for an interest rate cut – but expert opinion is mixed.

"Millions of Aussie borrowers are experiencing significant mortgage stress due to the fact that their monthly repayments have blown out so much and so rapidly," Cooke said.

"They're waiting with bated breath for any sign of relief from the RBA.

"The good news is our experts say there's a 56 per cent chance of a rate cut in the next 12 months.

"The bad news is one in three say we will see a rate rise."

READ MORE: Rattled by rising rates, 165,000 home owners may be forced to sell

Ratecity.com.au research director Sally Tindall said inflation is trending to forecast for the RBA at the moment – but that will come as little relief to borrowers struggling to meet their repayments.

"Last week's inflation figures handed the RBA a get-out-of-jail-free card for this week's meeting, but there's still a long road ahead for the central bank and the country," she said.

"The Board won't be high-fiving each other around the meeting room table, but rather breathing a sigh of relief."

READ MORE: First big four bank cuts interest rates – but there's a catch

Tindall said the RBA's inflation target was 2.5 per cent, and homeowners should be preparing for tougher times.

"Plenty of economists expect the next change to the cash rate will be down, not up, and while this may well eventuate, if you've got a mortgage, put the idea of rate cuts out of your head and plan for another hike, just in case," she said.

"Getting a rate hike you hadn't planned for isn't quite the same as getting a cut you weren't expecting.

"It can have disastrous consequences for those already living in the red."

The information provided on this website is general in nature only and does not constitute personal financial advice. The information has been prepared without taking into account your personal objectives, financial situation or needs. Before acting on any information on this website you should consider the appropriateness of the information having regard to your objectives, financial situation and needs.