EXCLUSIVE: When Kevin Coghlan decided to retire after a severe health scare, he did what anyone would do and checked in with his superannuation fund.

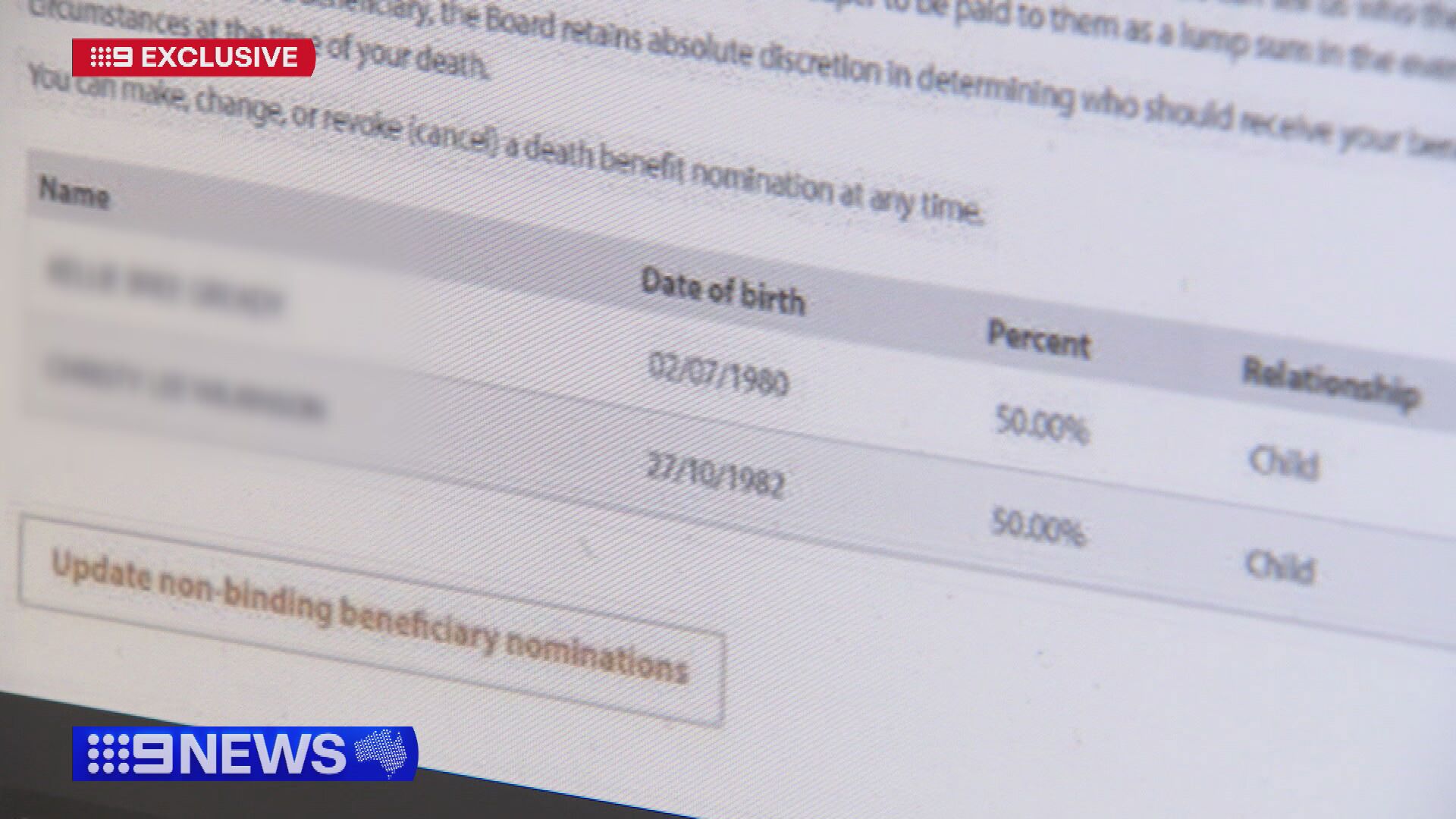

What he wasn’t prepared for was his shock when a representative from ESSSuper showed him the beneficiaries on his account: two women, both listed as his children.

The problem was the retired tram driver doesn’t have any daughters.

“I have one male child, not two female children,” he told 9News.

The women were total strangers and they’d been the beneficiaries on the account since 2021, when Coghlan signed up with the fund.

“There was a situation just recently where I could have died on the operating table,” he said.

“If I had, does that mean there are two people fighting for my superannuation? Two strangers?”

Coghlan said he was told by an ESSSuper employee that it was an easy process to change the beneficiaries.

“The person I was speaking to said, in a nonchalant type of manner, you can just go home and delete that and put whomever you wish.”

But the retiree is angry the error happened in the first place.

Coghlan assumed his account had been hacked, but ESSSuper told 9News it was a result of a “manual error”.

“At the point of joining there was another member who was joining at the same time and (their) beneficiaries have been applied to Coghlan’s account,” ESSSuper chief executive Robbie Campo told 9News.

“Since that time we have made changes so our processes are now digitised and that really reduces the opportunity for that kind of manual error.”

Campo also stressed the organisation believed the mistake was an isolated incident.

It has apologised to Coghlan.

The superannuation industry wants the story to serve as a reminder to always check account statements and details.

Additionally, Association of Superannuation Funds of Australia chief executive Mary Delahunty told 9News it would be incredibly rare for Coghlan’s funds to have been paid out to the women thanks to “rigorous” checks and balances in the event of someone’s death.

“Superannuation is not like an estate, it’s not the same as your will,” Delahunty said.

“The trustee is actually obliged to check the validity of that even when it’s a binding nomination.”