Artificial intelligence is already reshaping industries and changing economies. Over the next few years, its impact will only grow, making AI a key economic priority worldwide. However, a new study by Boston Consulting Group (BCG) reveals that most economies are not fully prepared for the disruption AI will bring.

The research assessed 73 economies and found that more than 70% score below average in important areas such as skills, research, and participation in the AI ecosystem. This means many countries are not yet in a strong position to manage the risks and opportunities AI presents.

The AI Maturity Matrix

To understand AI’s impact, BCG developed an AI Maturity Matrix that looks at two main factors. First, it assesses how vulnerable an economy is to AI-driven shifts, such as job displacement and productivity changes across industries. Second, it examines how well a country is prepared to manage the risks of AI while using it to drive economic growth.

The report also provides tailored recommendations for different groups of economies and includes an interactive dashboard for a more detailed analysis. It shows that while AI adoption is increasing globally, a small but influential group of leading economies is emerging. These frontrunners are positioned to gain significant economic advantages and play a key role in shaping how AI evolves.

Six Sectors Most Affected by AI

According to the study, six industries are most exposed to AI-driven transformation:

- Information and communication

- High-tech goods

- Retail

- Financial services

- Public services

- Motor vehicle manufacturing

Economies with a high share of these industries are among the most vulnerable to AI-related disruptions. For instance, financial services contribute nearly 30% of Luxembourg’s GDP, while in Hong Kong, financial and business services each make up 22%. In Singapore, business services account for 18%, retail 16%, and financial services 14%.

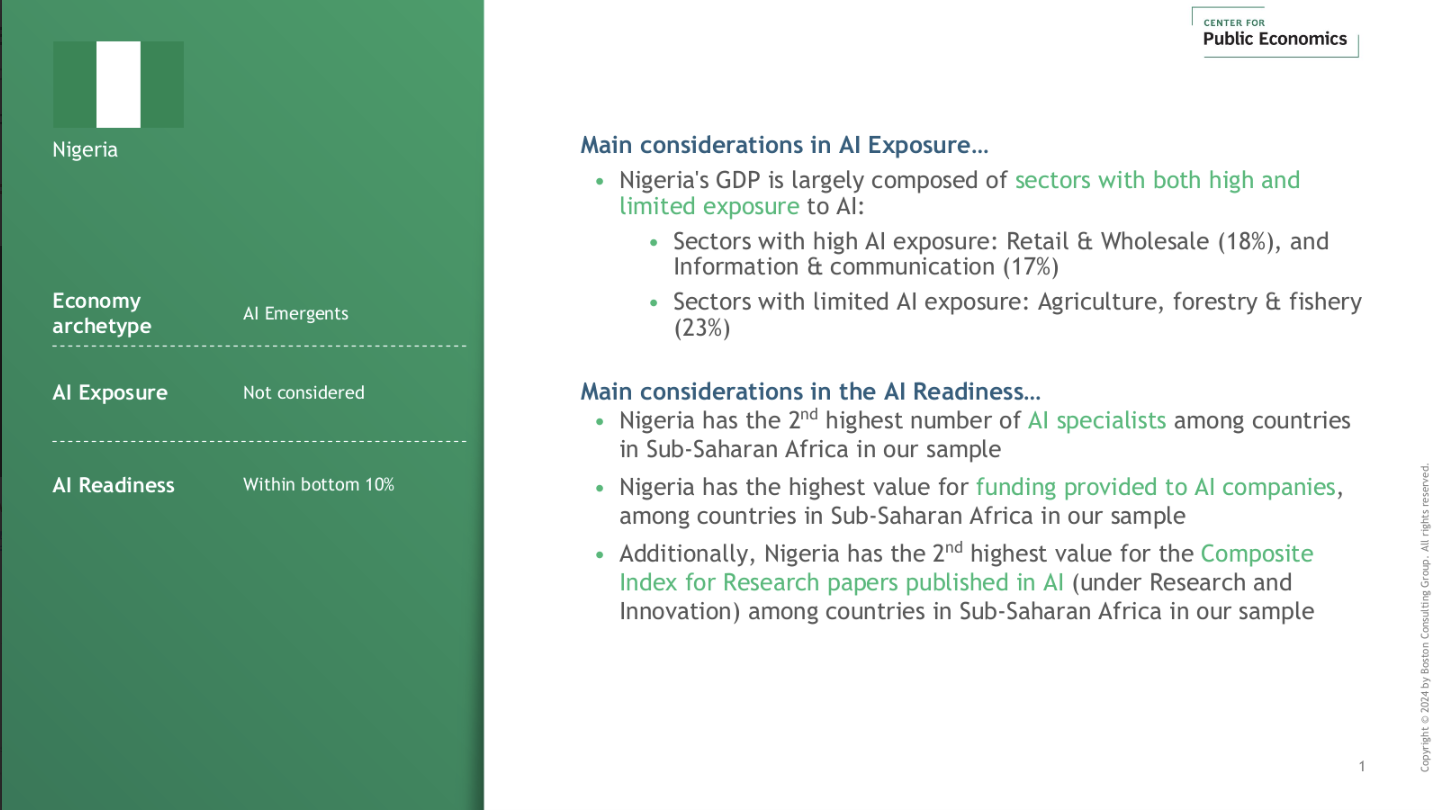

Nigeria’s economy includes both high-exposure and low-exposure sectors. Retail and wholesale contribute 18% to GDP, while information and communication account for 17%. However, the country’s largest sector, agriculture, forestry, and fishery, making up 23% of the economy has limited AI exposure.

This pattern reflects broader findings in the report, which show that economies with significant shares of industries less susceptible to AI disruption, such as construction, agriculture, and furniture manufacturing, are generally less exposed. For example, in Indonesia, agriculture makes up 13% of GDP and construction 11%. In India, agriculture accounts for 17% and construction 8%, while in Ethiopia, agriculture contributes 36% of GDP.”

Measuring AI Readiness Using the ASPIRE Index

BCG’s study also measures how ready different economies are for AI adoption. The ASPIRE Index evaluates six key areas:

- Ambition

- Skills

- Policy and regulation

- Investment

- Research and innovation

- Ecosystem

Among sub-Saharan African countries, Nigeria ranks highest in AI investment, with strong funding for AI companies. It also has the second-largest number of AI specialists and the second-highest research output in AI-related publications. South Africa follows closely in these areas.

Globally, only five economies—labelled as AI pioneers—have reached a high level of readiness. The United States and Singapore lead in AI talent, while the US also stands out in investment due to its well-developed capital markets. Mainland China leads in AI patents and academic research.

Six Types of AI Adoption

The study groups economies into six categories based on their exposure to AI and their readiness to adopt it:

- AI Pioneers – These economies have strong AI infrastructure, a skilled workforce, and a high level of investment in AI. They are expected to see AI contribute more to their GDP in the coming years.

- Steady Contenders – These economies have high exposure to AI-driven change but are also well-prepared. Many are high-income European nations, with Germany and Malaysia among the leaders.

- Rising Contenders – These countries have a mix of industrial and resource-based sectors, making them less exposed to AI. However, they are committed to AI adoption. India, Saudi Arabia, and Indonesia fall into this category.

- Gradual Practitioners – These economies, including Egypt, Kenya, Morocco, and South Africa, are adopting AI at a slower pace. Their industries, such as tourism, textiles, and agriculture, do not yet rely heavily on AI.

- Exposed Practitioners – These economies are at high risk from AI disruption but have lower readiness levels. Countries such as Malta, Cyprus, Bahrain, Kuwait, Greece, and Bulgaria are in this group.

- AI Emergents – These economies are still in the early stages of AI adoption and need to build strategies and infrastructure. Nigeria is part of this group, along with Angola and Ethiopia.

Preparing for an AI-Driven Future

To help economies navigate AI’s impact, the report outlines three key strategies based on their level of AI adoption:

- Enabling AI – Establishing the foundation for AI adoption in emerging economies.

- Accelerating AI – Supporting AI growth in economies that are making steady progress.

- Amplifying AI – Strengthening global leadership in AI for pioneer economies.

While Nigeria faces some challenges in AI readiness, the strong investment in AI companies and a growing talent pool provide a solid base for future development. By building on these strengths, Nigeria can improve its AI capabilities and ensure its economy is better prepared for AI-driven changes.

The report offers insights that policymakers can use to drive AI adoption and support economic growth across different industries.

***

This report was written by Boston Consulting Group. You can download the publication here. Feature image by Alex Knight for Pexels

The post How Prepared Are Economies for AI? A New Study Breaks It Down appeared first on BellaNaija – Showcasing Africa to the world. Read today!.