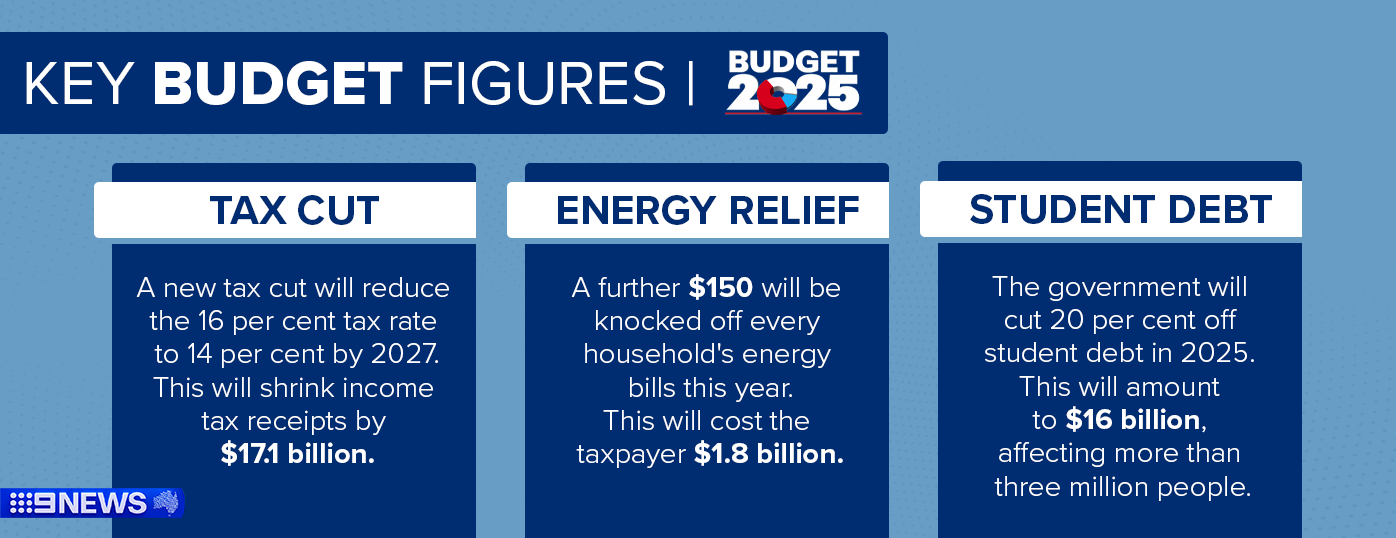

Every single Australian taxpayer would be handed a tax cut next year under a $17 billion measure included in Treasurer Jim Chalmers’ fourth federal budget.

Cost-of-living relief has remained front and centre in the national accounts and Australians earning any taxable income will soon receive some “modest” relief.

If returned to government, Labor is set to deliver two more tax cuts in 2026 and 2027 on top of the stage 3 measures that rolled out in 2024.

Shadow Treasurer Angus Taylor tonight told 9News chief political editor Charles Croucher the opposition “are not matching this election bribe”.

“This is a budget for the next five weeks, not for the next five years and beyond,” he told 9News chief political editor Charles Croucher.

“And what was offered was a bribe, election bribe of 70 cents a day, starting in a year’s time.

“And frankly, this is not even going to touch the sides of the economic pain that Australian households have felt over the last two and a half years.”

If implemented, the combined cuts would save the average worker $2548, or $50 per week, by the 2027-28 financial year.

The new tax cuts will impact every person earning above $18,200, and the government says it will give Australians up to $268 every year, starting July 1, 2026.

That will increase to up to $536 in 2027, according to the budget papers.

Combined with Labor’s 2023-24 tax cuts, the average Australian will have seen an extra $2548 in their bank accounts.

However, this amount will vary and it depends on how much you earn.

Unlike some tax cuts which are given in a lump sum, this tax relief will be delivered every time you get paid.

You’ll start seeing this change in payslips from July 1 next year.

What do the new tax cuts look like?

If you’re earning below $18,201 you won’t get a cut, because you don’t pay tax on your income as it is.

It’s important to note the most an average earner on $79,000 will get back in their payslip annually will be $536 by 2027.

The federal government is rolling their stage 3 measures into today’s figures and the combined total includes the cuts from July 1 last year.

From July 1 next year, the lowest tax bracket rate of between $18,201 and $45,000 will be reduced from 16 per cent to 15 per cent.

In 2027, this rate will be cut further to 14 per cent.

This means someone earning $40,000 per year will save $1090 in tax across Labor’s three tax cuts since 2024.

Around 2.7 million taxpayers will enjoy this series of rate cuts over the next few years.

It marks the lowest tax rate for bottom income earners in 50 years, according to the government.

Around 80 per cent of taxpayers earn above $45,000 and this demographic will also enjoy a small change to their pay packet.

Australians earning between $45,001 and $135,000 will see their annual taxes slashed by between $1340 and $4265.

Those on incomes between $135,001 and $190,000 will have between $4265 and $5065 back in their pocket, while those earning above $190,001 are set to save a capped amount of $5065 per year.

“These additional tax cuts are modest but will make a difference,” Chalmers said during his federal budget speech.

“Our $17 billion in tax cuts are the biggest part of the responsible cost-of-living package in this budget. ”

According to the budget papers, the average taxpayer earning $79,000 will save around $30,000 in tax under these cuts by the 2035-36 financial year.

Chalmers also announced an increase on the Medicare levy low-income thresholds, which will be raised to 4.7 per cent from July 1 to ensure one million Australians will continue to either pay a reduced rate or remain exempt from the levy.

These changes to personal income tax will cost $17.1 billion over the forward estimates.

The government expects the tax cuts will encourage Australians, especially women, to work more hours and increase total weekly work hours by 1.3 million.

The Albanese government’s rejigged stage 3 tax cuts passed parliament last year, with all taxpayers receiving a cut from July 1, 2024.