Treasurer Jim Chalmers has handed down his fourth federal budget – the last before his government heads to the polls for this year's election.

While once again the treasurer is promoting the policies as helping out all Australians, as always some groups will look at the budget with far more fondness than others.

Here are all the winners and losers.

EXPLAINED: The surprise tax cut coming for every single Aussie taxpayer

TWO-MINUTE GUIDE: Everything you need to know with the budget back in deficit

READ MORE: Multi-billion dollar pay rise for 60,000 workers

Winners

Taxpayers

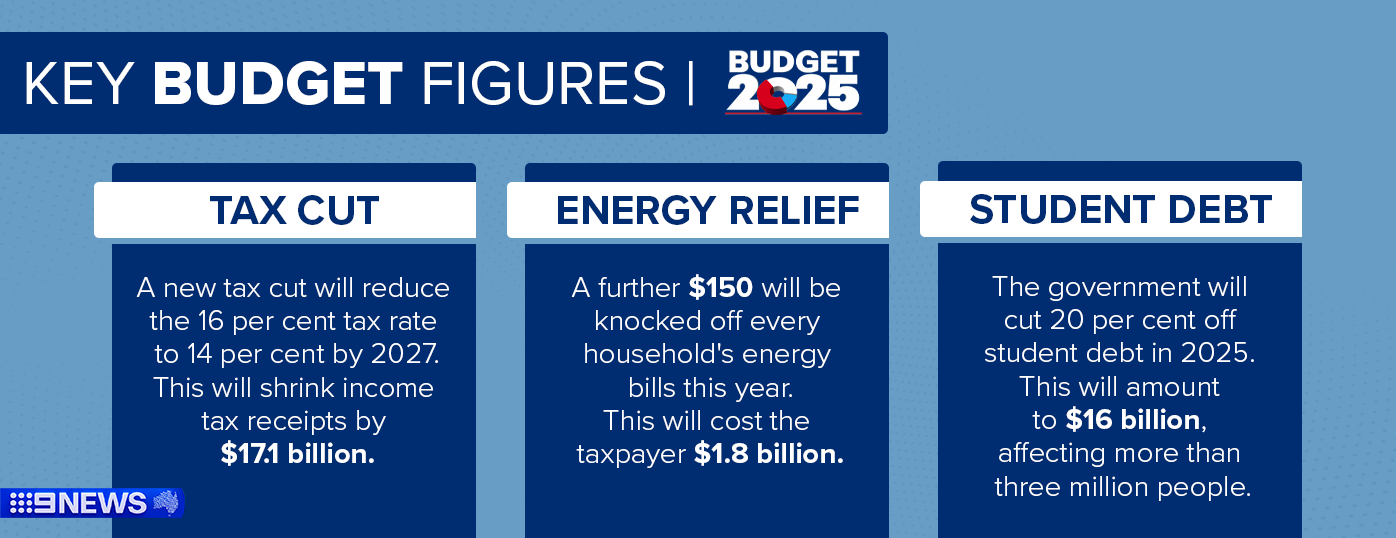

Every single person who pays tax on their income will be a winner in this year's budget.

Combined with the stage 3 tax cuts implemented last year, the federal government will deliver more tax relief in 2026-27 and 2027-28: up to a $256 cut in the first year, which will be doubled the year after.

People who buy medicine

The federal government has invested $784.6 million to reduce the cost of medicines listed on the Pharmaceutical Benefits Scheme (PBS) down to no more than $25 per prescription.

This could save a familiy filling four prescriptions per month around $316 per year, the budget states.

There's also $1.8 billion to list new medicines on the PBS.

READ MORE: Cheap medicine, free GP visits under $124.8b healthcare budget

Bill-payers

Households and small businesses will receive $150 off their energy bill as the government allocates $1.8 billion to extend last budget's rebates to the end of this year.

Australians will receive the discount as two $75 rebates through to December 31, as last year's $300 rebate had been set to expire by July 1.

HOUSING CRISIS: Budget doubles bonus for tradie apprentices in one industry

Women's healthcare

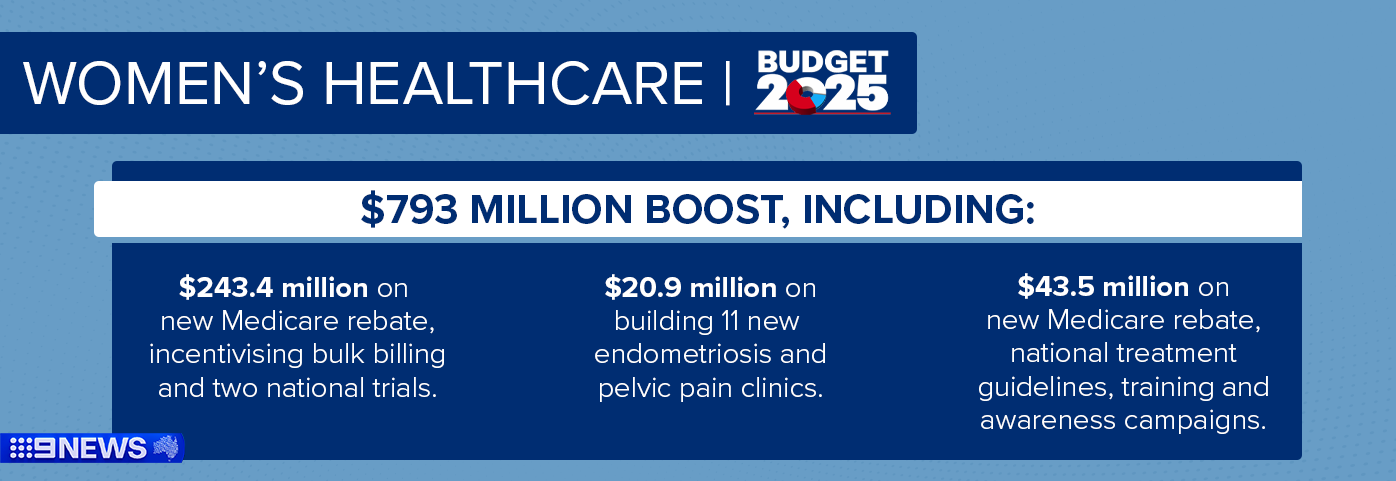

Hundreds of thousands of people are set to benefit from a $792.9 million boost to women's healthcare, which will target endometriosis and pelvic pain, contraception and menopause.

New items were listed under both the Medicare Benefit Scheme and the Pharmaceutical Benefits Scheme, making it cheaper and easier to access medicines and healthcare services.

Anyone with student debt

Three million Australians will have a combined $16 billion cut from their student loan debt from June 1 as the government slashes the total amount owed by 20 per cent.

READ MORE: Budget reform could send three million workers into a better job

Stuck workers looking to change jobs

Three million workers are in jobs governed by non-compete clauses, meaning they can't go work for their employee's competitors, or set up shop in the same field themselves.

The government has announced that from 2027, these clauses will be banned for anybody earning less than $175,000 a year.

Treasury claims the measure will add $5 billion to GDP and lift wages by an average of $2500, as well as boosting economic productivity – a measure governments have struggled to address.

Aged care nurses

A total of $2.6 billion will go towards pay increases for aged care nurses.

This will roll out across the next five years, starting this month.

READ MORE: Here's what the budget predicts our lives will look like in 2028

Childcare workers

Similarly, there's a big provision in the budget – some $3.6 billion – for childcare worker pay increases.

Apprentices

An apprentice tradie who trains up in the housing construction industry can expect a $10,000 incentive bonus – double the current amount.

The government is trying to increase its workforce for a big housing push.

Beer drinkers

Anyone who enjoys a pint will be quick to complain about how much the cost of a beer at the pub has risen by, which is in part due to how much the alcohol excise has risen by in recent years.

However, the government has hit pause on the indexation for that excise on draught beer for the next two years, a measure that will cost the budget $165 million over five years

WHAT'S IN IT FOR WOMEN: Critical $793 million health boost

Green metal manufacturers

With plenty of uncertainty around Australian steel and aluminium manufacturing thanks to US President Donald Trump's trade war, the government is looking to boost the sector with a combined $3 billion to support locally made "green" aluminium and iron.

Losers

Renters

While the government has thrown an extra $800 million into its Help To Buy shared equity housing scheme, there's little by way of new immediate help for renters still struggling – certainly nothing comparable to last year's Commonwealth Rent Assistance boost.

READ MORE: How tobacco is blowing a hole into the Federal Budget

The budget bottom line

After delivering back-to-back budget surpluses – Australia's first since the GFC – on the back of some very welcome revenue upgrades, the national accounts have fallen back into the red to the tune of a $27.6 billion deficit, and there are even larger ones forecast to come in the next few years.

That's in part due to far fewer revenue upgrades – budget papers state they are only one-sixth of what was averaged in the past five budgets – as well as the black hole that is tobacco excise; Treasury has downgraded the amount of tobacco excise it expects to collect until 2028-29 by almost $7 billion.

Farmers

Many of the government's grocery-related measures were generally focused on consumers, and there was little directed specifically at farmers in this year's budget papers.

That's despite Chalmers' promise following the ACCC's report last week, to pursue a "fair go" at the "farm gate", as well as promoting a similar message in tonight's budget speech.

Big supermarkets

That being said, the government is still promising to crack down on major supermarkets, by allocating $38.8 million for the Australian Competition and Consumer Commission (ACCC) to probe misleading and deceptive pricing practices and unconscionable conduct in the sector.

Welfare recipients

While Australian welfare recipients had their paymints rise thanks to indexation last week, advocates had been calling for biggest boosts, particularly to JobSeeker.

"This routine indexation is not enough. If the Federal Government is serious about addressing the cost of living crisis, it must lift income support payments to at least $82 a day, in line with the age pension," Australian Council of Social Services Cassandra Goldie said before the budget.

"An additional 22 cents a day does not address the inadequacy of JobSeeker and related payments. Ensuring people have a sufficient income to cover the basics would transform lives."

The government, though, opted against a boost for the welfare payments.

Sugar tax advocates

The Australian Medical Association last week called for a tax on sugar-sweetened drinks to combat Australia's obesity crisis, while at the same time adding $3.6 billion in revenue to the budget.

The federal government has ignored the suggestion.

Russia and Belarus

The federal budget confirmed a two-year extension to 35 per cent tariffs on goods from Russia and Belarus in response to the invasion of Ukraine.

The tariffs now extend to October 24, 2027.

DOWNLOAD THE 9NEWS APP: Stay across all the latest in breaking news, sport, politics and the weather via our news app and get notifications sent straight to your smartphone. Available on the Apple App Store and Google Play.