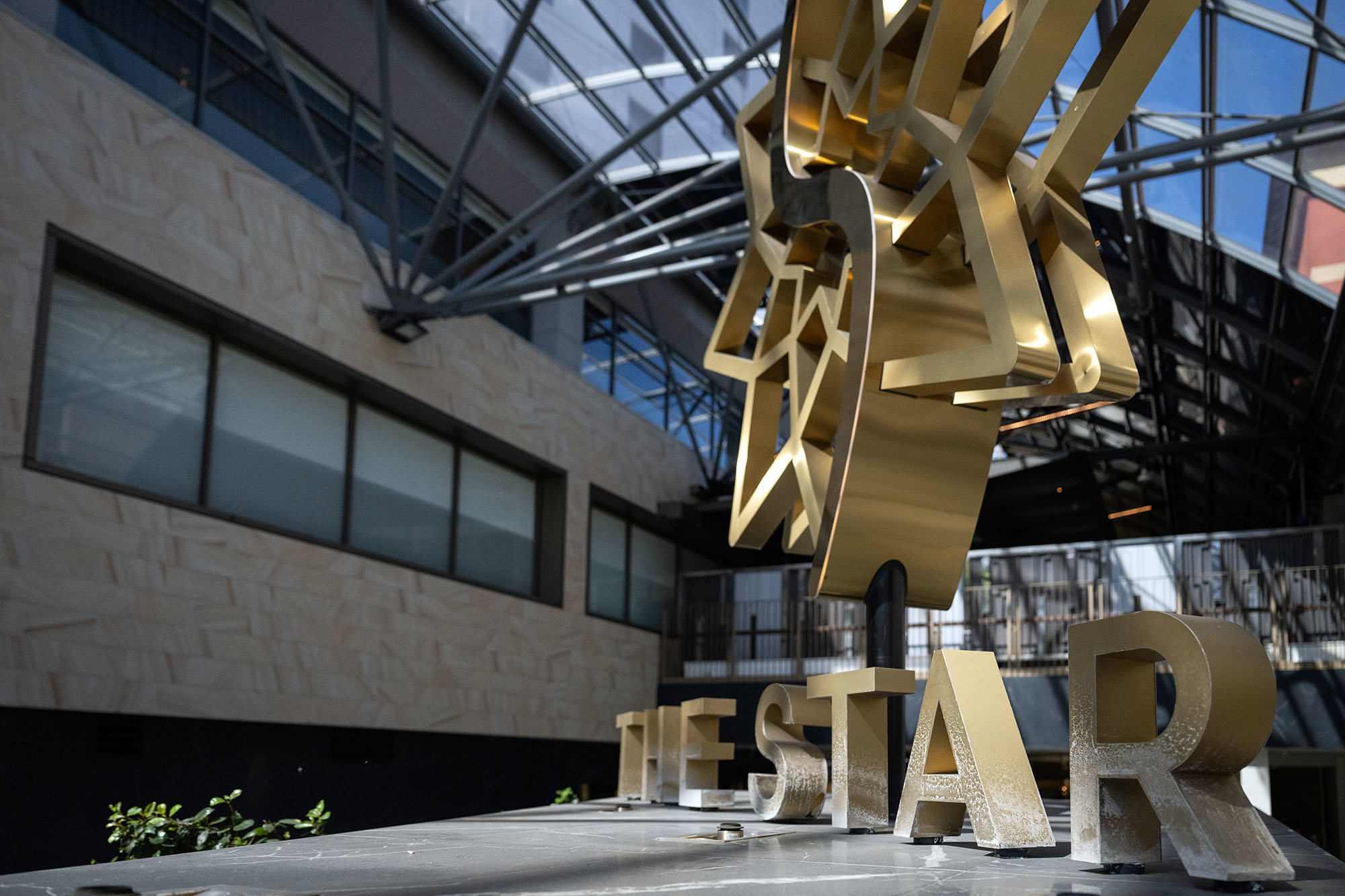

Star Entertainment has avoided falling into administration after securing a $300 million lifeline from US casino giant Bally's Corporation.

In a statement to the ASX tonight, Star announced it had entered into a binding term sheet with Bally's that will inject $300 million into the floundering casino operator in exchange for $33.4 million in shares.

Star's largest shareholder, billionaire publican Bruce Mathieson, could front up $100 million for the deal, reducing Bally's investment to $200 million.

READ MORE: Two killed, four injured in horror multi-vehicle crash

The board of The Star intends to unanimously recommend that shareholders vote in favour of the transaction, the statement to the ASX said.

The deal comes after talks for a $940 million funding deal with local investment managers Salter Brothers fell through last week.

The Star, which runs casinos in Sydney, Brisbane and on the Gold Coast, has been in financial distress for some time now.

It revealed in January that it was down to just $79 million in the bank at the end of 2024 after burning through $107 million in the previous three months, and was put in a trading halt after failing to post its half-yearly results in time in late February.

Its shares last traded at 11 cents, about 2 per cent of their value in 2018.

In 2021, the Star was found to have allowed organised crime and money laundering to infiltrate its Sydney casino by a NSW government investigation.

DOWNLOAD THE 9NEWS APP: Stay across all the latest in breaking news, sport, politics and the weather via our news app and get notifications sent straight to your smartphone. Available on the Apple App Store and Google Play.