Australian shares closed with a $56.6 billion loss today, the largest in eight months, following major falls across world markets triggered by US President Donald Trump's sweeping tariffs.

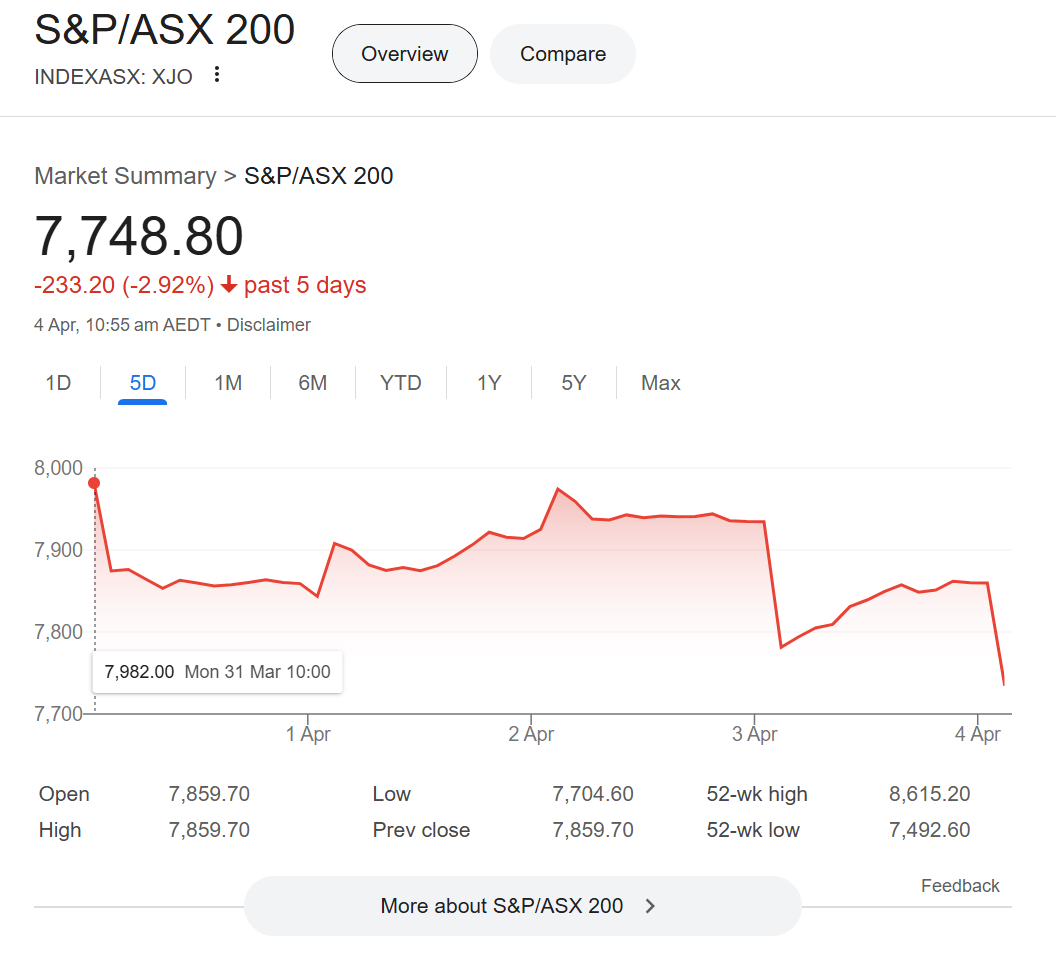

The S&P/ASX 200 Index fell 2.4 per cent, or by 191.9 points, to 7667.8 points by the bell.

Most industry sectors, bar consumer essentials, recorded major falls. Stocks in energy companies were hit especially hard, collapsing nearly 8 per cent amid concerns over an increase in oil supplies.

READ MORE: Australia has been hit by Trump's new tariffs. How will they impact the economy?

Trump's sweeping new tariffs on American imports have shocked governments and investors around the world, swiftly spurring both threats of retaliation and calls for negotiation as industries scrambled and global stocks tumbled.

Australian exports to the US are now subject to a 10 per cent tariff, substantially lower than other nations and trade blocs.

Only about 4 per cent of exported Australian goods go to the US, leaving the vast majority unimpacted.

Trump imposed a 34 per cent levy on goods from China on top of an earlier 20 per cent tariff, as well as a 20 per cent tariff on the European Union, 24 per cent on Japan and 25 per cent on South Korea.

China is Australia's largest trading partner, and a reduction in demand there would hurt our exporters.

READ MORE: This is the dubious way Trump calculated his 'reciprocal' tariffs

The round of tariffs jolted financial markets, with the US Standard & Poors 500 off 3.7 per cent in afternoon trading.

The STOXX Europe 600 index fell 2.7 per cent and a 2.8 per cent drop in Tokyo's benchmark led losses in Asia. Oil prices sank more than $US2 a barrel.

It now looks like a full-blown global trade war will be unleashed as China the EU. South Korea, Mexico and India pledged retaliatory measures on US goods.

Analysts fished for superlatives to a step that disrupts the global trading order and overturns decades of efforts to lower tariffs through trade talks and free trade agreements.

"The magnitude of the rollout — both in scale and speed — wasn't just aggressive; it was a full-throttle macro disruption," Stephen Innes of SPI Asset Management said in a commentary.

Deutsche Bank's Jim Reid called it "radical policy reordering" and said the US now had an average tariff of 25 per cent-30 per cent, the "worst end of expectations" and the highest since the early 20th century.

– With AP

DOWNLOAD THE 9NEWS APP: Stay across all the latest in breaking news, sport, politics and the weather via our news app and get notifications sent straight to your smartphone. Available on the Apple App Store and Google Play.