Mindful of the pressure on household budgets, Treasurer Jim Chalmers has handed down a small-spending federal budget that strayed as far as possible from traditional descriptions of a "cash splash".

Despite a more than $4 billion surplus – the first of its kind in 15 years – the Albanese government chose to carefully funnel its unexpected windfall of tax revenue toward the nation's most vulnerable.

From single parents to solar power installers and even smokers – these were the winners and losers of the 2023 federal budget.

TWO-MINUTE GUIDE: What's in it for me?

COST OF LIVING: The measures that will offer the most relief

WINNERS

Aged care workers

More than 250,000 aged care workers in Australia, including registered nurses and home care professionals, will receive a pay increase of 15 per cent under a huge $11.3 billion package.

For some workers, this will represent a near-instant pay increase of up to $10,000 per annum when the new financial year rolls around in July.

Women

Several initiatives in this budget have been targeted at demographics that overwhelmingly comprise of women – from single parents to those on JobSeeker aged over 55.

Cheaper childcare from July will help women return to work sooner, while an extended paid parental leave scheme will encourage more fathers to spend more time away from work or to take on the role of primary carer.

More than 85 per cent of the aged care workforce receiving a pay increase are women, while $8.6 million is being spent on boosting the number of women in apprenticeships, traineeships and cadetships.

READ MORE: Older Australians get biggest boost as budget sets JobSeeker increase

Single parents

Single parents or sole carers of a dependent will have their base payment continue to be paid to them until their youngest child turns 14, up from the previous age of eight.

In September, around 57,000 eligible single parents, of whom around 91 per cent are women, will transition to a parenting payment with the current basic rate of $922.10 per fortnight until their youngest child turns 14.

This is an extra $176.90 per fortnight compared to the current JobSeeker payment.

Older welfare recipients

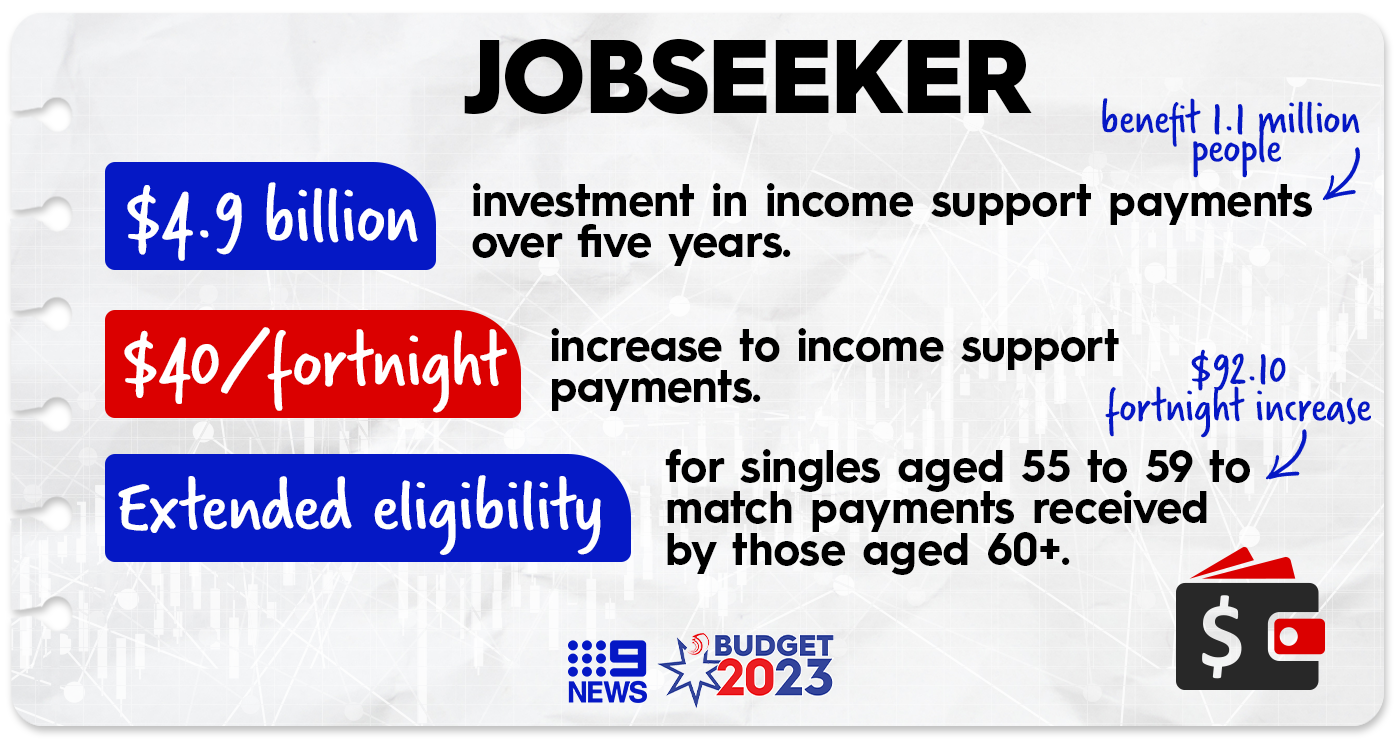

For all recipients, the base rate of JobSeeker is increasing by $40 per fortnight from September 20, 2023.

But for recipients aged 55 to 59, the news is even better – they will automatically have their payment increased to a higher rate typically reserved for recipients aged 60 and over.

The only catch? Eligible 55-year-olds will have have been on the payment for nine or more continuous months to receive the supercharged rate.

BROKEN DOWN: All the cost of living measures to save you money

Veterans

An enormous backlog in claims by veterans will be assisted with $64.1 million being spent on more resources, along with more than $250 million being spent to upgrade the IT systems of veteran services.

To meet future expected claims, a further $4.8 billion will be funded for the compensation and support payments owed to veterans.

Renters receiving assistance

Renters who are currently on Commonwealth Rent Assistance will see the maximum rates increased by 15 per cent, at a cost of $2.7 billion to budget.

In real terms, this equates to around a $31 per fortnight increase in rental assistance payments, which is expected to help around 1.1 million households.

Potential homebuyers

Aussies looking to buy a house will have greater scope to cobble together a deposit with loved ones or friends under a newly expanded Home Guarantee Scheme.

As part of the new changes, any two eligible borrowers can apply to the scheme beyond married or de facto couples – meaning friends or business partners could come under the scheme.

Furthermore, Australian permanent residents will also be eligible.

Small businesses

More than $290 million is being spent in cash flow support to give small businesses an instant asset write-off of $20,000.

This means up to 3.8 million small businesses with an annual turnover of less than $10 million will be able to immediately deduct eligible assets costing less than $20,000 from July 1 2023.

READ MORE: The 11 million Aussies who are eligible for free GP visits

Patients

Australians who regularly see their doctor, have a script filled or find their local hospital to be overwhelmingly busy will be boosted by a huge $5.7 billion investment in Medicare.

The funding will provide eight new Medicare Urgent Care Clinics, and will provide higher bulk billing incentives for GPs, particularly for children under the age of 16, pensioners and other concession card holders.

Under changes to the Pharmaceutical Benefits Scheme, general patients will be able to save up to $180 per year on medicines now prescribed for 60 days instead of 30.

Eco-tradies

Tradies specialising in eco-friendly upgrades to residential homes can expect the phones to start ringing, with a huge investment being made to make Australian's homes more efficient.

The $1.3 billion Household Energy Upgrades Fund will create low-interest loans to help households install measures such as solar panels or double-glazed windows to cut down on energy use.

Artificial intelligence

If you're a semi-sentient being trapped in some circuitry cobbled together by clumsy human hands, well you're in luck: the government is providing $101.2 million to support the growth of "critical technologies" such as artificial intelligence.

Under the funding a new program will be created that rewards the nation's brightest minds in the fields of AI and quantum technology.

Former smokers

Australians who have given up the smokes but continue to worry about the health of their lungs are in luck: the government is investing $263.8 million over four years from 2023-24 to establish a new national lung cancer screening program.

In real terms that means Australians will be able to access free lung cancer screening tests up to twice a year, particularly if they live in a rural or regional area.

EXPLAINED: JobSeeker goes up by $40 – here's exactly who will get it

Government coffers

For the first time in 15 years, the government's yearly budget is marked with a black pen instead of a red one.

This year's budget delivered an unexpected $4.2 billion surplus, with 82 per cent of revenue upgrades to the bottom line returned back to the budget.

It is important to remember that a budget surplus is simply the government's income against its spending for one financial year – Australia's gross debt is still an eye-watering $887 billion.

READ MORE: Billions on the table for power price relief for eligible households, businesses

LOSERS

Middle and upper class Australians

Australians who are well off – or not receiving any form of government assistance – found little joy in this budget, with the vast majority of big-spending items going towards the nation's most financially vulnerable.

For the very-well off with over $3 million in superannuation, the news gets a little worse: they won't be able to continue to make concessional contributions at the reduced tax rate of 15 per cent.

Vapers and smokers

Recreational vaping is set to be all but banned, and smokers will see the tax on cigarettes – both rolled and loose-leaf tobacco – increase by 5 per cent per year, for three years.

More than $63 million will also be spent on a new national advertising campaign that outlines the dangers of vaping and smoking.

READ MORE: The cash sweetener for renters amid a surging property market, with a catch

Dodgy fishmongers

Fishmongers trying to pass off imported seafood as being locally sourced will be put under the microscope, with the government committing to the rollout of "country of origin" seafood labelling for the next 12 months.

Scammers

Scammers who swindle victims by sending "spoof" text messages – which impersonate official organisations such as Linkt or myGov – will be disheartened to hear that $10.5 million is being spent to establish an SMS Sender ID registry.

The registry will mean scammers could no longer fake sending texts from industry or government brand names.

Sign up here to receive our daily newsletters and breaking news alerts, sent straight to your inbox.