The federal budget is being touted by Treasurer Jim Chalmers as being for "every Australian".

But as ever, some are better off than others.

So who should be celebrating and who will feel hard done by?

These are our winners and losers.

ANALYSIS: RBA governor is the real audience for this year's budget

TWO-MINUTE GUIDE: What's in the federal budget

Winners

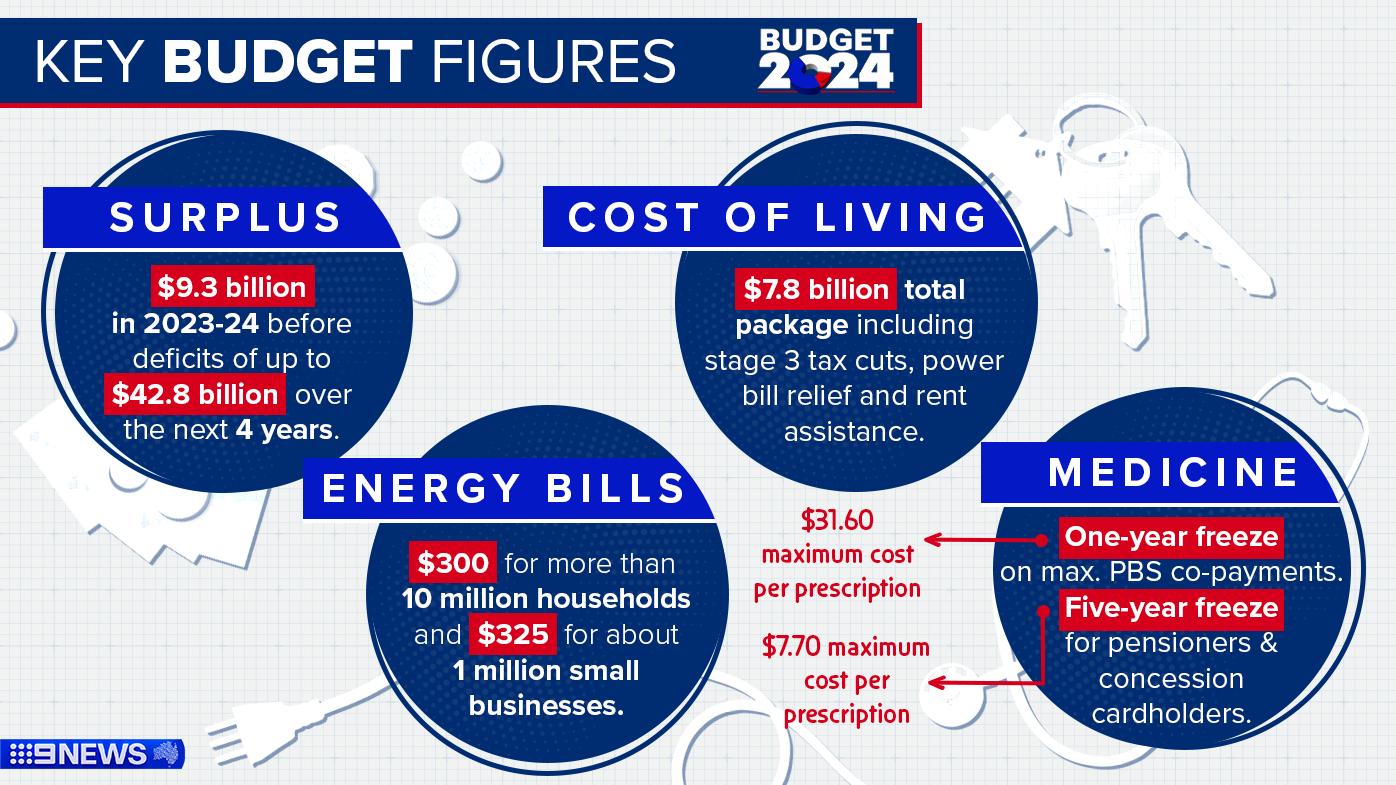

Taxpayers: All 13.6 million taxpayers in Australia will receive a tax cut on July 1 through the already legislated stage 3 cuts, first delivered by the previous Coalition government and revised by Labor earlier this year.

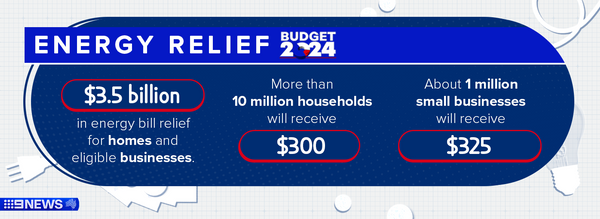

All households: Every household in Australia will receive $300 off their energy bill through a rebate.

Small businesses: Around one million small businesses will receive $325 off their power bills. The $20,000 instant asset write-off scheme has also been extended, while 457 "nuisance tariffs" will be abolished.

Renters: Commonwealth Rent Assistance will be increased by a further 10 per cent, on top of a 15 per cent increase last year – the first back-to-back increase in more than 30 years. The government says nearly 1 million households will benefit.

ENERGY BILL RELIEF: $300 for every household, $325 for small businesses

RENT ASSISTANCE: The increase to rent assistance explained

People on JobSeeker with limited work capacity: JobSeeker recipients able to work up to 14 hours a week are now eligible for the higher rate, an increase of $54.90 a fortnight. The change is expected to benefit 4700 people.

People who use medicines listed on the PBS: The maximum co-payment for prescriptions on the Pharmaceutical Benefits Scheme will be frozen for a year at $31.60. For those on the aged care pension and concession card holders, that maximum co-payment will be frozen for five years at $7.70 per prescription.

Pensioners: In addition to the five-year freeze for PBS medicines for people on the aged care pension, pensioners will benefit from the deeming rate being frozen for another year. Used to estimate how much people earn on financial assets and means-test welfare payments, it's been set in stone since 2022 rather than shifting at the start of each financial year. By extending the freeze until the end of June next year, the government says 870,000 people, including 450,000 age pensioners, will be better off.

BUDGET FOR WOMEN: What's in the budget for women?

Students: Students are some of the big winners tonight, thanks in large part to measures the government has already announced.

Chief among them is the change to student debt reindexation, which has been backdated ton last year and will wipe about $3 billion off the nation's collective HECS-HELP debt.

There's also Commonwealth Prac Payment – up to $319.50 per week for students during their clinical and professional placements in an attempt to combat "placement poverty" that will start in mid-2025.

Parents: The government is spending $1.1 billion to pay superannuation on government-funded paid parental leave for parents of babies born or adopted on or after July 1, 2025.

READ MORE: Single sentence spells bad news for mortgage holders

Losers

All other JobSeeker recipients: Chalmers' responses to questions about potential welfare increases in the lead-up to the budget had sparked speculation that the maximum JobSeeker rate would be increased.

The government's Economic Inclusion Advisory Committee (EIAC) had called for JobSeeker to be pushed up to 90 per cent of the aged care pension, and the treasurer had said the budget would include steps "conscious of its recommendations" when asked about a JobSeeker boost.

But instead of lifting the maximum rate, the government opted instead to make less than 5000 existing recipients eligible for the highest payment – a not-so-whopping 0.06 per cent of all JobSeeker recipients.

As for the other 99.4 per cent, they'll stay on the same payment, which the EIAC described as "well below all poverty lines used in Australia".

FOREIGN AID: Where our money is going overseas

The major supermarkets: The country's biggest supermarkets have been firmly in the government's eye this year amid complaints about soaring grocery prices.

An interim report by economist and former Labor minister Craig Emerson earlier this year recommended the supermarket code of conduct be changed from the current voluntary, punishment-less agreement to a mandatory system with proper financial penalties.

The government says it will take that advice and make the code mandatory, and will also strengthen Australia's mergers regime to increase competition in the sector.

"Because more competition means more choices, lower prices, better services and better jobs," Chalmers said.

READ MORE: Everything in the budget to help the cost of living

Alcohol producers: Local breweries and distilleries hoping for the federal government to hit pause on the alcohol excise will be disappointed by tonight's budget.

Australia has one of the highest alcohol taxes in the world, which increases twice a year in line with inflation.

That's been a contributing factor in the particularly high number of craft breweries collapsing and falling into administration in recent months, leading the Independent Brewers Association to call for the government to freeze the beer excise for two years "to help our industry survive". Spirits and Cocktails Australia had previously called for a spirit excise freeze after it passed $100 per litre of alcohol last year.

WEIRD STUFF: The things you might have missed in the budget

But the government hasn't heeded those calls, and is set to receive an increasing amount of excise payments in the coming years – $2.63 billion for beer and $3.34 billion for spirits this financial year, rising up to $3.17 billion and $4.17 billion respectively in 2027-28.

NDIS fraudsters: It's one of Australia's most valued support schemes, but the NDIS has been marred by reports of fraud and spiralling costs.

The government is looking to crack down on that, with $468.7 million for the NDIS in the budget, including $214 million to combat fraud as well as design reforms to the scheme in co-ordination with people who have a disability.