Many Australians are selling their homes for big profits, with new data released today showing resales have reached their highest rate of financial gain in 14 years.

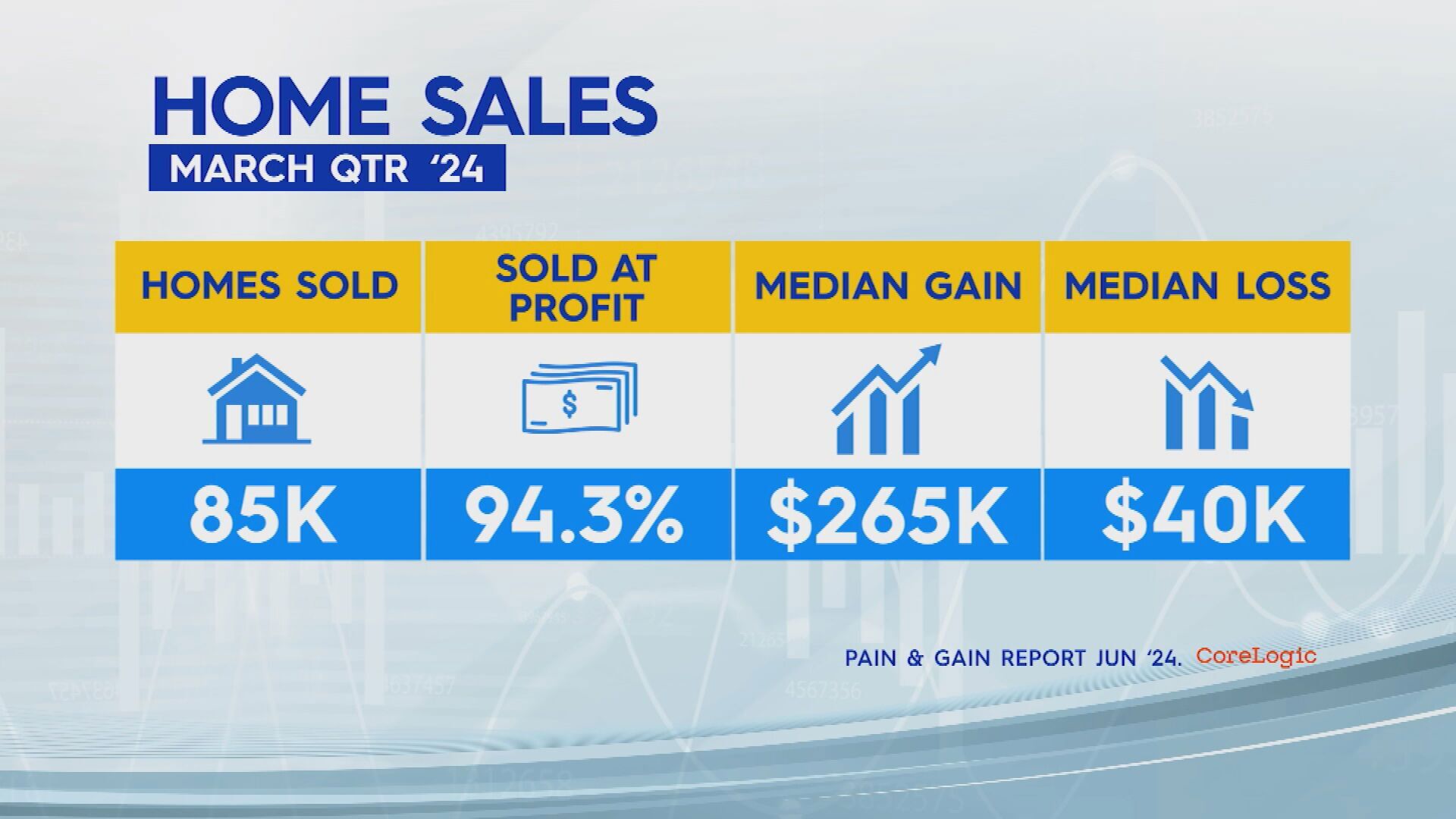

From the 85,000 resold properties during the first quarter of this year, more than 94 per cent recorded a nominal gain, according to the latest CoreLogic Gain & Pain report.

The medium gross profit was $265,000 and the median loss was $40,000.

READ MORE: Shock surge pushes inflation up to highest level this year

The research also revealed owners that held onto their property the longest reap the most profit over 30 years.

But sellers in some capital cities made more money than others, according to the report.

Adelaide and Brisbane were joint first for the most profitable state capitals in resales during the quarter, with only 1.6 per cent of them recording a loss.

Besides the Northern Territory, Melbourne had the highest rate of loss-making resales in the quarter, rising to 9.2 per cent from 8.9 per cent in the previous December quarter.

Next was Sydney at 8.4 per cent, staying unchanged from the previous quarter.

READ MORE: Julian Assange pleads guilty in US court

The report also pointed to a major resurgence in the Perth housing market over recent years. In June 2020, the Western Australia capital recorded 43.8 per cent of loss-making sales, compared with 6.4 per cent in this year's March quarter.

Across Australia, house sales continued to deliver bigger profits over units. The research shows 97.1 per cent of house resales made a nominal gain in the March quarter, compared with 89 per cent of units.

The median nominal gain for houses in the March quarter was $320,000, while for units the figure was $172,500.