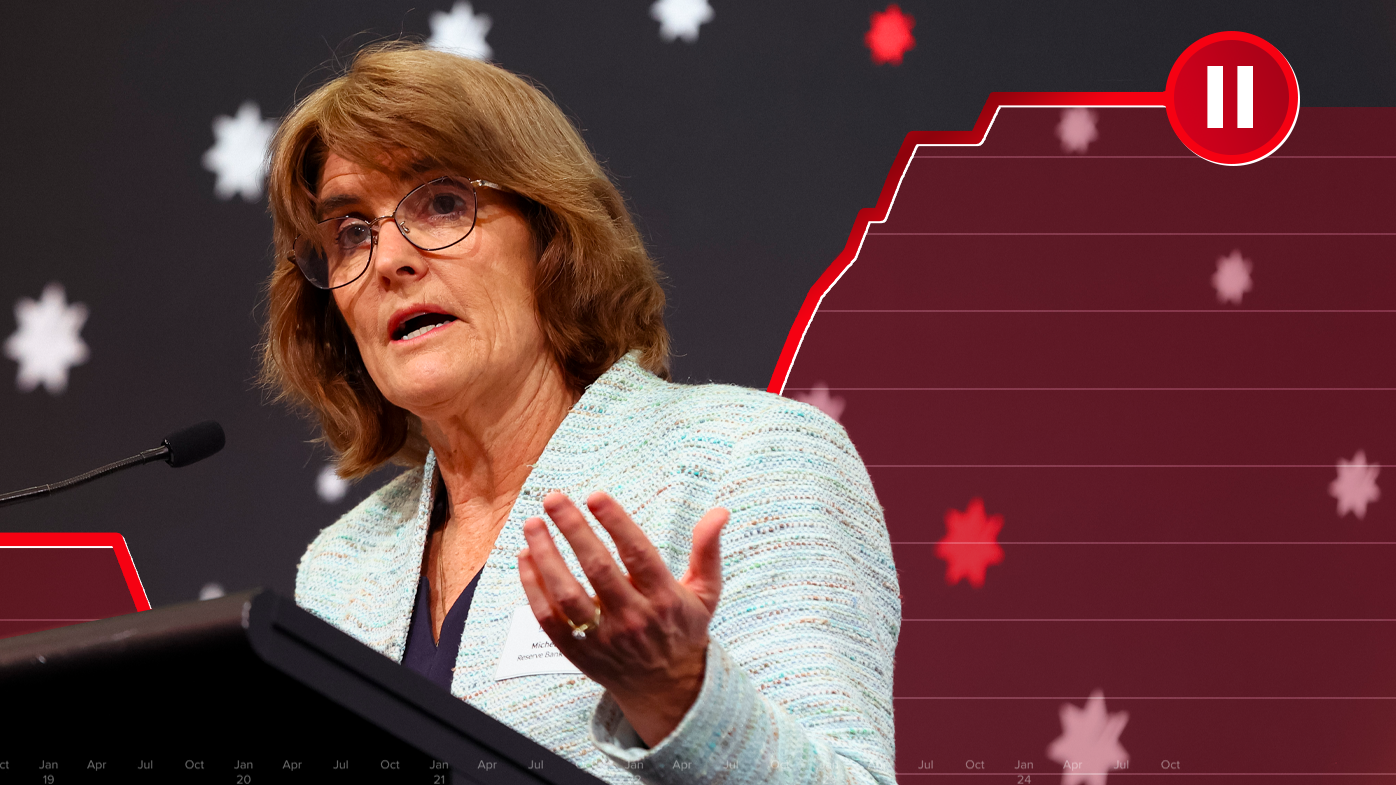

The Reserve Bank of Australia (RBA) has kept the nation's cash rate target on hold for the seventh consecutive meeting, despite increasing pressure from at home and abroad to ease the cost of lending.

Concluding its two-day meeting this afternoon, the RBA board decided to keep interest rates on hold at 4.35 per cent, unchanged since November 2023.

The central bank has come under greater scrutiny to cut interest rates of late, following comments by Treasurer Jim Chalmers that the current cash rate target is "smashing the economy".

READ MORE: 'Perfect storm' forces $170m Aussie dairy into administration

Five days ago the US Federal Reserve cut its benchmark interest rate by an "unusually large" half-point, prompting many local pundits to call for the same measure to be taken locally.

In its monetary statement the RBA board said it was mindful of the squeeze on household budgets but the current economic conditions did not warrant a cut in the September meeting.

"The Board will continue to rely upon the data and the evolving assessment of risks to guide its decisions," the statement reads.

"In doing so, it will pay close attention to developments in the global economy and financial markets, trends in domestic demand, and the outlook for inflation and the labour market.

"The Board remains resolute in its determination to return inflation to target and will do what is necessary to achieve that outcome."

Thousands of borrowers have been anxiously awaiting a cut in interest rates, with many reporting that the prolonged exposure to a rate of 4.35 per cent is starting to eat into household savings.

READ MORE: Melbourne mayor posts 'creepy' AI-generated images depicting body next to a child

Graham Cooke, head of consumer research at Finder, said many homeowners are juggling their finances with a view to seeing interest rates reduced in early 2025.

"Due to the sharp and rapid rise in mortgage repayments, millions of Aussies are under significant financial stress," he said.

"A whopping 40 per cent of homeowners say they are struggling to pay their home loan in September, according to Finder's Consumer Sentiment Tracker."

Cooke said the erosion of borrower's personal savings will likely see levels of personal debt soar.

"Less in savings means people are more likely to have to rely on credit cards, loans, and buy-now-pay-later products to get by," he said.

"These products can be great if used properly, however they can quickly get out of hand if relied on for everyday expenses."

READ MORE: Major change begins for holiday rentals in tourist magnet

Sally Tindall, director of data insights at Canstar, said scheduled monthly repayments have collectively increased by an estimated $5.5 billion compared to March 2022.

"It's incredible to think Australian borrowers are having to shell out an extra $5.5 billion a month in mortgage repayments. What's even more incredible is that most households are managing to make it work," She said.

"Cash rate cuts will be music to borrowers' ears but the RBA is unlikely to move any time soon.

"Underlying inflation is tracking in the right direction but the reality is, it's still sitting firmly in the 3's.

"With unemployment holding steady at 4.2 per cent, the RBA has cover to continue its 'wait-and-see' strategy to get the job done, and properly."

FOLLOW US ON WHATSAPP HERE: Stay across all the latest in breaking news, celebrity and sport via our WhatsApp channel. No comments, no algorithm and nobody can see your private details.