More than 500,000 Australians are likely to pay the federal government's proposed superannuation tax increase over the coming decades.

The new analysis by the Financial Services Council (FSC) today comes as the Albanese government faces heavy criticism from the opposition and industry bosses over the proposed changes to super.

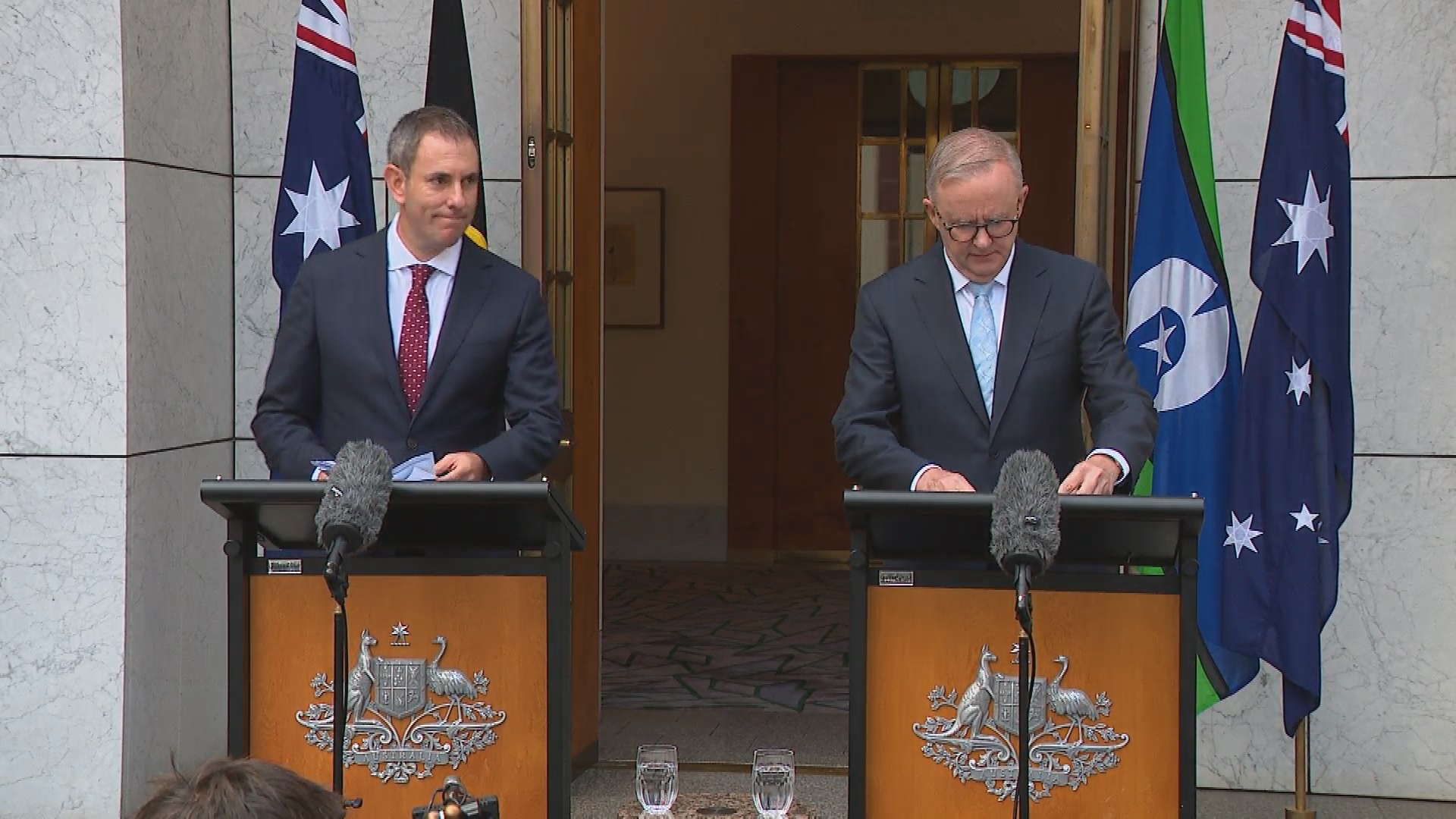

Earlier this week, Treasurer Jim Chalmers announced superannuation balances above $3 million will have their concessional rate doubled from 2025.

READ MORE: Foreign Minister Penny Wong calls on China to help end Ukraine war

From July 1 2025, Australians who have a superannuation balance over $3 million will be taxed at a concessional rate of 30 per cent, up from 15 per cent.

Prime Minister Anthony Albanese said the change would impact about 80,000 people but the FSC, which represents big retail super funds, found six times as many Australians could be affected.

The new analysis estimated when younger people start to retire over the coming decades they will face paying the tax because the $3 million cap not indexed to inflation, reports The Sydney Morning Herald.

It could impact about 500,000 people over the long-term as people now in their 20s and 30s retire when they are 65.

"Leaving the cap stuck at $3 million will mean that in today's dollars, a 30-year-old will have a real cap of around $1 million, calling into question the intergenerational fairness of an unindexed cap," FSC chief executive Blake Briggs said.

The super changes will come into effect after the next election and will not be retrospective but will rather apply to future earnings.

Albanese said earlier this week the reform will make the country's $3.3 trillion super system more sustainable.

READ MORE: Couple forced to live in caravan as WA housing crisis worsens

Chalmers said the average superannuation balance is about $150,000 and the number of Australians who have more than $3 million in their super all the way up to $400 million is very small.

The superannuation tax concessions cost the government around $50 billion a year, the government said.

But shadow treasurer Angus Taylor claimed Labor has broken an election promise by imposing the super tax concession changes.

"Australian super is Australians' money, that must be the starting point," he said.

Taylor said with rising interest rates, Australians are trying to make ends meet and the super balances should be left alone.

Sign up here to receive our daily newsletters and breaking news alerts, sent straight to your inbox.