While most Australians are content in retirement, two-thirds say they are worried about financial security amid the cost-of-living crisis, a study has found.

The YouGov study, commissioned by investment firm Challenger, surveyed 1000 Australians over 60.

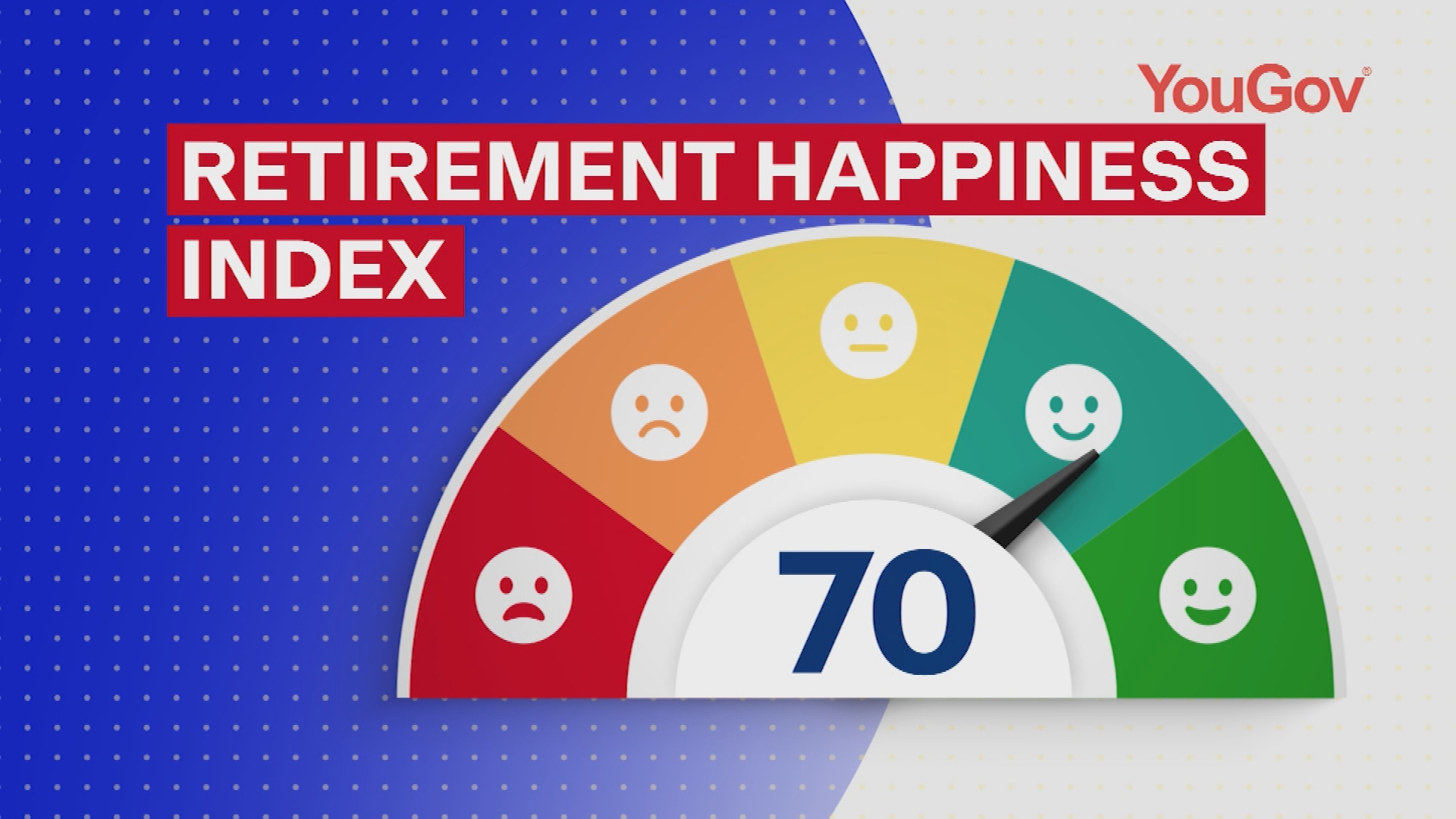

It indicated that while retirees sit at 70 out of 100 on the Retirement Happiness Index, two-thirds say the rising cost of living has impacted their sense of financial security.

READ MORE: Fresh evidence reveals drug and prostitute claims in Lehrmann case

Another 38 per cent said they were worried they would run out of money during retirement.

"(The cost-of-living crisis) creates uncertainty today for people who are trying to live on a budget," author and retirement expert Bec Wilson told 9News.

"Financial and retirement literacy is actually really fundamental.

"If you don't understand the systems, you will have a natural fear of even looking at your super statement."

Retired couple Terry and Kerry Cavendish say they have found the saving "sweet spot" by consulting with experts to set up an annuity for regular income.

"Every month, you know you're guaranteed to get that money and it just gives you peace of mind, it's just a no-brainer, like set and forget," Kerry said.

READ MORE: Ex-NRL star Jarryd Hayne's second appeal against rape conviction begins

The couple have spent their retirement travelling overseas, spending time with their grandchildren and taking up an interest in vintage cars.

"Everybody would have their views on what their dream is, this is our dream," Terry said.

Participating in various activities brought the most joy to retirees, the survey found, followed by mental wellbeing and a sense of purpose and social connection.

Money, mental health and physical health were the three biggest concerns survey participants were worried about.

"It's a really positive picture, we just need to ensure that financial security comes to more Australians," Challenger CEO Nick Hamilton said.

"Underspending is the same as under-retiring, not knowing how much you can safely consume."

Retirees can speak to their super fund about money concerns or use the Money Smart retirement income calculator to determine how much they need in super.